Apr 19, 2024

Skittish Oil Market Enters an Uneasy Calm Over Middle East Risk

, Bloomberg News

(Bloomberg) -- At no stage this week did crude futures trade higher than where they were last Friday, before Iran’s attack on Israel.

And while prices jumped again this Friday after reports that Israel had struck back, futures ultimately turned lower to close little changed. It’s a sign that — for now at least — traders are betting regional tensions won’t morph into a conflict that ruptures global oil supplies anytime soon.

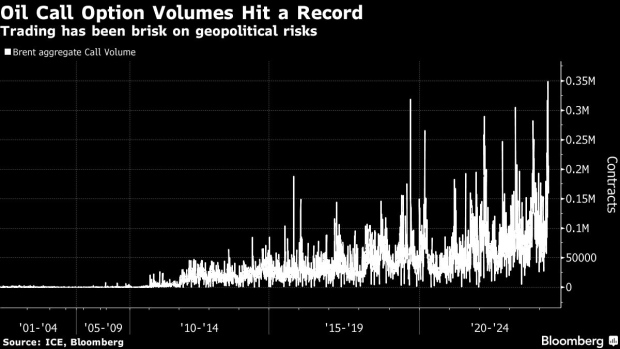

That’s only one side of the story, though. Intraday, prices are seeing some of their biggest swings in months and, in the options market, speculators have been snapping up contracts at a record pace to profit from any spike higher in futures.

Read More: Popular Oil Trade Falls Out of Favor as War Risks Haunt Market

It all paints a picture of an oil market that has grown more sanguine about disruption in the short-term, but also one in which that perception can shift from moment to moment.

“While it is difficult to assess whether this is a temporary blip or the start of a new escalation in the conflict between Iran and Israel, the initial market reaction suggests the former is more likely,” said Jorge Leon, an analyst at consultant Rystad Energy.

Even as benchmark Brent prices hold between $85 and $90 a barrel, the risks to crude are beginning to grab global attention. A senior International Monetary Fund official warned on Friday that there’s the potential for a severe oil shock.

Now traders are piling into the options market — where insurance can be bought relatively cheaply to protect against a spike and could even return fortunes.

Trading of bullish Brent call options surged to a record this week. Such contracts continue to hold a hefty premium over bearish puts — though they have diminished in recent days. That’s a sign of a market where people covering themselves against a rally.

The total amount of bullish call options on Brent held by traders is at the highest since 2020, and there are more calls with a strike price of $110 over the next 12 months than any other contract. There are even calls with a strike price of $150 or more, an indication that some market participants are betting on — or protecting themselves in the event of — sky-high oil prices exceeding even the spike that followed Russia’s invasion of Ukraine.

“The problem with geopolitical challenges is you’ve got to think hard about the tail risks,” Nathan Sheets, Global Chief Economist at Citigroup Inc., said in a Bloomberg TV interview. “The key question is very much what the markets are focused on, and that is: ‘What are the implications of this for oil supply?”

Even before the deterioration of the situation in the Middle East, oil prices had been robust. The Organization of Petroleum Exporting Countries and its allies are keeping about 2 million barrels a day of supply off the market, and analysts have generally been raising their forecasts for global consumption this year.

But some of oil’s lackluster reaction this week comes amid signs that demand is softening. Premiums for fuels like diesel and naphtha have eased and prices for some real-world crude grades aren’t as strong as they were a month ago.

Another factor keeping a lid on prices is a relatively large buffer of spare capacity, in part thanks to the very cuts being implemented by OPEC+. Last week, the International Energy Agency warned the group could soon have one of its largest supply buffers ever as production from outside the group continues to expand. That puts a limit on how high prices can rise.

For now, though, oil prices are jumpy.

Brent futures on Friday swung in their biggest intraday range since November, leaving traders entering the weekend in much the same way they did a week earlier — waiting on the next moves by Israel and Iran.

“If there is a serious escalation – which means a much more wider regional escalation than what we’ve seen so far — then yes, we could have a severe oil shock,” Gita Gopinath, the International Monetary Fund’s First Deputy Managing Director, told Bloomberg Television. “But we’re not there yet.”

--With assistance from Devika Krishna Kumar.

©2024 Bloomberg L.P.