Mar 19, 2024

SNB Discloses Carbon Footprint, Won’t Change Investment Policy

, Bloomberg News

(Bloomberg) -- The Swiss National Bank won’t change how it invests its huge foreign-currency reserves for environmental reasons, once again rebuffing calls for it to take a more active stance on climate change.

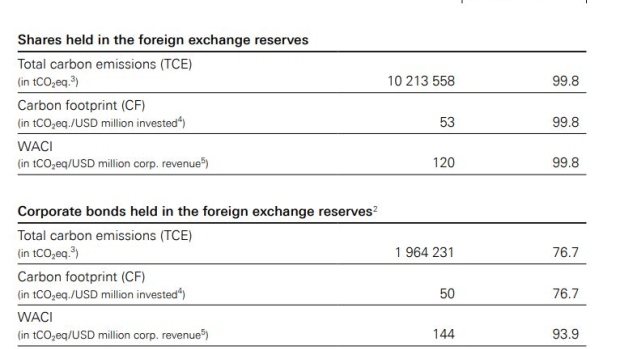

It said it’s “not authorized to pursue structural policies” and pursuing such actions could make it more difficult for it to fulfill its primary mandate of inflation control. The SNB was commenting in its Sustainability Report, where it disclosed the carbon footprint of its portfolio for the first time. A new law came into force this year obliging large Swiss companies to be transparent on their climate impact.

The SNB “may not influence economic, political or social developments through its investment policy,” it said. “This also applies to pursuing a plan to reduce” greenhouse gas emissions.

While certain companies are excluded from the SNB’s portfolio — in particular arms-makers and banks — the SNB’s environmental rules only ban coal miners. That means its holdings include firms involved in fracking, and the oil and gas industries.

But the central bank said Tuesday that as the climate change transition affects companies, and their stocks and bonds, that will also affect the SNB’s broad portfolio of holdings.

“Diversification means that the SNB’s equity and corporate bond portfolios’ exposure to risks is similar to that of the global universe of companies, and that structural changes, for example the transition to a sustainable economy, are also reflected in the SNB’s portfolios,” it said in the report.

Central banks are increasingly addressing climate change issues, with many citing risks to financial stability from rising global temperatures.

Sweden’s Riksbank sold bonds in Australian and Canadian states with high carbon dioxide emissions, and the European Central Bank began prioritizing purchasing bonds from lower-polluting companies

Meanwhile, the Network for Greening the Financial System, created in 2017 by a handful of central banks, has now grown to 138 members, including financial supervisors. The SNB joined in 2019.

But critics say environmental issues have been a distraction for central bankers and they should focus on their core inflation mandates. SNB President Thomas Jordan said in January that central banks lack the tools to fight climate change.

--With assistance from Frances Schwartzkopff.

©2024 Bloomberg L.P.