Oct 22, 2019

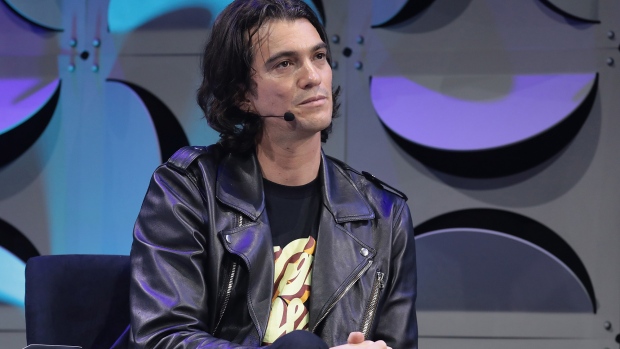

SoftBank Takes Control of WeWork as Part of Bailout, Adam Neumann Leaves Board

, Bloomberg News

(Bloomberg) -- SoftBank Group Corp. is taking control of WeWork, part of a rescue financing plan that will see founder Adam Neumann depart from the company’s board, according to people familiar with the matter.

Neumann is expected to sell about $1 billion of stock to the Japanese investment firm as part of the deal, said the people, who asked to remain anonymous because the deal hasn’t been announced. He can also assign two board seats and will get a roughly $185 million consulting fee.

WeWork had been considering two separate rescue packages from SoftBank and JPMorgan Chase & Co., to keep it from running out of money as soon as next month.

JPMorgan had been putting together a $5 billion debt package for WeWork, which would have been one of the riskiest junk-debt offerings in recent years.

SoftBank, WeWork and JPMorgan either declined to comment or couldn’t immediately be reached. Dow Jones earlier reported details of the deal.

The bailout underscores the rapid unraveling of the startup. Just this summer, WeWork appeared to be headed toward a rich initial public offering. But public investors spurned the company, which lost $900 million in the first half of this year. As its estimated valuation cratered, WeWork last month ousted Neumann as chief executive officer and, eventually, pulled its IPO paperwork.

To contact the reporter on this story: Gillian Tan in New York at gtan129@bloomberg.net

To contact the editor responsible for this story: Craig Giammona at cgiammona@bloomberg.net

©2019 Bloomberg L.P.