Nov 4, 2022

SPAC Sponsors That ‘Piled In’ During Boom May Face $4 Billion Tab

, Bloomberg News

(Bloomberg) -- Blank-check sponsors that jumped on the bandwagon to cash in on the SPAC boom may be stuck with a roughly $4 billion bill as they close up shop and return money to investors. That’s on top of the estimated $352 million they’ve already lost this year.

The SPAC craze was a goldmine for sponsors like “SPAC King” Chamath Palihapitiya and Howard Lutnick. They were early to the game and benefited from a bull market that bolstered the industry with investors eager to pay large premiums for a pile of cash. Now that the bubble has burst, sponsors who “piled in during the boom in 2021” could lose billions, according to Jay Ritter, professor of finance at the University of Florida.

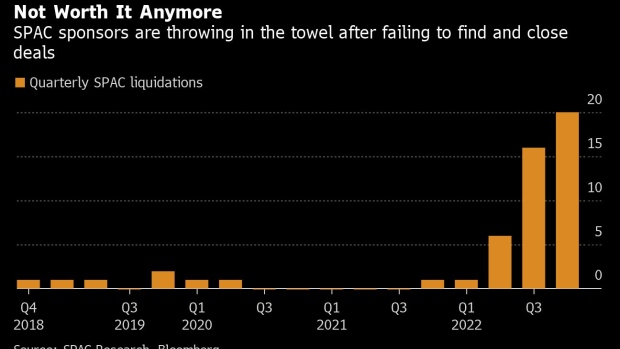

Sponsors on average could lose about $8 million of at-risk capital -- mostly fees for underwriters and others -- on each liquidation, Ritter says. With 646 active SPACs either hunting for targets or pushing to complete them, and an average of roughly eight deals completed a month this year, he expects more than 80% of SPACs will need to close down.

That would result in losses of about $4.1 billion across the failed ventures. But that number may be closer to $5 billion given most recent SPACs essentially paid investors extra for buying into the initial public offering, Ritter says.

“A lot of these fairly sophisticated financial professionals were a bit guilty of chasing past returns,” Ritter said by phone. “Six months from now it might be worthwhile for a sponsor to take a SPAC public, but I’ve been scratching my head for the past 18 months over the rush to spend $8 million to get into an incredibly competitive market.”

So far this year, 44 SPACs have closed and returned the billions they raised to investors, compared to just one over the same period in 2021. Dozens more are working to close up shop before the end of the year.

Alec Gores, one of the most well-respected sponsors, said Thursday that three of his SPACs, which raised a combined $1.3 billion last year, want to shutter soon. While the firm is “committed to the SPAC product in the long-term,” it acknowledged the “current reset in the SPAC market is necessary in light of the activity over the past two years,” Gores said in a statement.

The issues for SPACs include a closed window for traditional IPOs and a battered economy, as well as pressures from US regulators. Before the boom days resulted in more than 800 new SPACs in a two-year period, the market had presented a niche opportunity for companies that wanted to go public without some of the caveats of an IPO.

That turned upside down when stuck-at-home retail traders flush with cash and Wall Street pros looking to turn a quick profit took them mainstream.

Bubble Gets Burst

“This is bubble activity,” says Enrique Abeyta, of the billions in looming sponsor losses. Abeyta follows SPACs as editor of Empire Financial Research. “The vast majority of these SPACs are going to not do anything,” he said.

The fallout from failed efforts has hit experienced teams, those with little to no SPAC experience and the countless firms that tied their hopes to celebrities and athletes. Both Palihapitiya and Bill Foley have given up one two SPACs recently. Financier Patrick Orlando is clamoring to close the deal between Digital World Acquisition Corp. and Donald Trump’s media venture to avoid a third failed venture.

To be sure, many sponsors in the early days reaped massive benefits from their ventures. For the 284 SPACs that completed deals or closed from 2015 to September 2021, sponsors had an average net payoff of at least $46 million, according to a paper from Ritter and Minmo Gahng and Donghang Zhang. That means their total profits over that stretch were about $13 billion.

“Kind of like real estate investors in 2001-2008,” those who got in early did “very well on average,” while the group that was late to the party lost money, says Ritter.

©2022 Bloomberg L.P.