Aug 17, 2022

Spain Burns More Gas in Costly Setback to Drive for Clean Power

, Bloomberg News

(Bloomberg) -- A quirk in Spain’s rules to cap the price of gas used to make electricity is having an undesired impact by pushing a cleaner, more efficient type of generation technology to the sidelines.

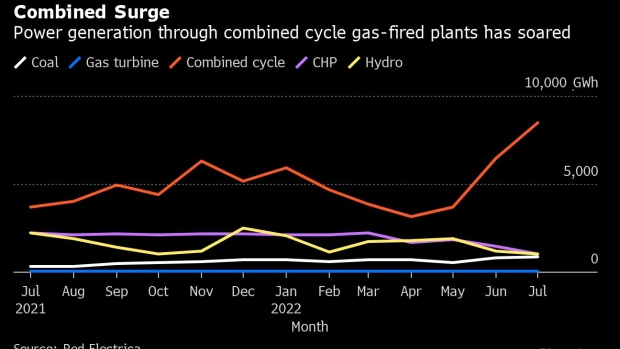

Demand for gas to generate power jumped 126% in July compared with the same month of a year earlier, according to network operator Enagas SA. At the same time, the country’s use of a less-polluting energy technology called CHP tumbled.

Combined heat and power generation -- which optimizes output by producing both electricity and thermal energy -- accounted for just 4% of the country’s energy mix last month, down from 10% a year earlier. The reason for the decline in CHP generation is that Spain didn’t include the technology among those benefiting from a cap on gas prices that took effect on June 15.

The upshot is that CHP plants have no option but to purchase gas at prices driven higher after Russia’s invasion of Ukraine squeezed supplies of the fuel. While some facilities have ceased production as a result, the combined cycle plants, which are more polluting, have been able to benefit from lower costs under the price-cap program.

“That’s the reason why more than half of CHP plants were forced to halt, and the rest are producing at a loss,” Javier Rodriguez, general director of the Spanish CHP Association, said in an interview. “That’s never happened before.”

Putting Strain

The decline in CHP is putting strain on industries - ranging from food and paper to refining and chemicals - that had invested in tapping the technology. Meanwhile, that reduced output is being offset by increased generation from less efficient and more polluting technologies, such as gas-fired combined cycle and, to a lesser extent, coal.

The share of those two sources in total Spanish power generation more than doubled in July, reaching 32% and 3.3%, respectively. All in all, technologies emitting CO2 accounted for 42% of Spain total mix, a 11 percentage-point increase from the same month a year earlier. A harsh drought that halved hydro output also contributed to that trend.

That all runs counter to the government’s declared goal of making Spanish power generation cleaner and more efficient. In its energy and climate plan for 2021-2030, Spain has targeted a 23% cut in greenhouse gases compared to 1990 levels.

“The situation is serious,” said Roger Medina, an economist at Barcelona School of Economics. “A drop in CHP reduces efficiency, increases pollution and has a direct impact on industrial output.”

Bloomberg Intelligence: A prolonged and severe drought in Spain and Portugal is pushing baseload hydroelectric output to historical lows, prompting increased calls for gas-fired power. This risks partially negating the easing of spot price volatility via the region’s gas-price cap by intensifying demand beyond peak times.

-- Patricio Alvarez, BI Industry Analyst

-- Joao Martins, BI Associate Analyst

Link: Iberian Drought Pressures European Gas, Power Supply Further

The reason Spain gave at the time for excluding CHP plants from the price cap was that they already operate under a separate compensation regime, according to Rodriguez.

A spokesperson for the ministry for environmental transition, which supervises Spain’s energy policy, didn’t reply to emailed questions.

Another problem facing CHP plants in that the government hasn’t updated its compensation formula for the technology since the first half of 2020, even though it should do so every six months, said Rodriguez.

Plants should be allowed to take advantage of the price cap or the government should tweak the incentives system to take account of the current geopolitical situation, he said. “Otherwise there’s no way to for us to be competitive.”

©2022 Bloomberg L.P.