Sep 8, 2022

Spain Plans to Ease German Gas Crunch With Revived LNG Terminal

, Bloomberg News

(Bloomberg) -- Spain expects a gas import facility that it is reviving after a decade of being idle will help ease an unprecedented energy crunch in Germany.

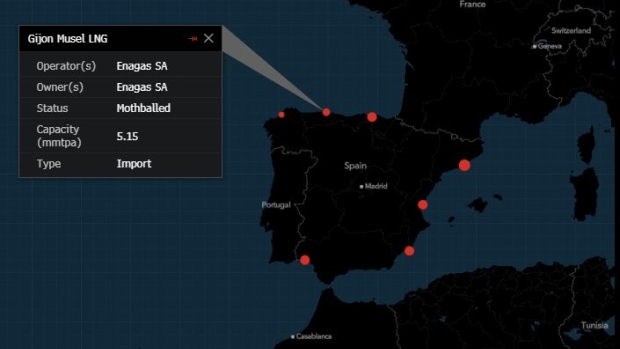

The Iberian nation, which already has six operating liquefied natural gas terminals, plans to restart the El Musel regasification plant in January. It will allow traders to bring in fuel, store it in tanks onsite and, when required, potentially transport it by ships to LNG terminals that Germany is setting up. The El Musel project was mothballed as soon as it was constructed 10 years ago because of a lack of demand.

“Our priority now is to try to expand as much as possible our capabilities to export gas to the rest of Europe, taking advantage from the very strong gas infrastructure that we’ve got,” said Arturo Gonzalo Aizpiri, chief executive officer at the Soanish gas network operator Enagas SA.

Spain to Start Using 10 Year-Old Regasification Plant in 2023

Germany, traditionally heavily reliant on Russian gas, is among the worst affected in Europe as an energy crisis heightens the risk of drastic rationing, economic recession and social unrest. Germany will start as many as three fast-tracked floating LNG import terminals this winter, but more are needed to ensure sufficient supply, especially if the winter turns out to colder than usual.

El Musel’s first storage tank will become operational in January, and the second in March, Gonzalo Aizpiri said in an interview at the Gastech conference in Milan, where his company tested market interest for gas supply from Spain’s terminals. The re-exported gas is likely to mainly head to Germany, he said.

If the German floating storage LNG units are going to be extremely busy, “probably it would be useful for them to have this intermediate storage capacity in our plants,” he said. “This will give flexibility and storage capacity to European operators, mainly in Germany.”

Enagas is also taking other steps boost gas shipment capacity to Europe:

- Increase compression capacity on current pipeline to France by 1.5 billion cubic meters a year to 8.5 billion annually before the end of 2022.

- Boosting supply to Italy by as much as 2.5 billion cubic meters by sending gas through small LNG vessels.

- Plans to build new gas pipelines to France and Italy. “We are convinced that Europe should be going forward with this,” Gonzalo Aizpiri said.

While political debates on cross-border link continue, the pipeline to France is at an advanced stage and could be ready to start shipping gas next autumn, depending on agreements. The other to Italy may take longer as the project isn’t as advanced, Gonzalo Aizpiri said. That project could transport 10 to 15 billion cubic meters annually, and is estimated to cost around 3 billion euros ($3 billion), he said.

“We are in a better position than other countries and we feel comfortable,” the CEO said. “We are convinced that we won’t have to face blackouts or restrictions, but it doesn’t mean that we are immune, because we are also exposed to the prices that Europe is living.”

©2022 Bloomberg L.P.