Jun 26, 2022

Stagflation Threat Needs Central Bank Action, BIS Warns

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The world economy risks entering a new era of high inflation which central banks need to keep in check, the Bank for International Settlements said.

“The risk of stagflation looms over the global economy as the threat of a new inflation era coincides with a weaker outlook for growth and elevated financial vulnerabilities,” the BIS, which is commonly known as the “central bank for central banks,” said in its annual report on Sunday.

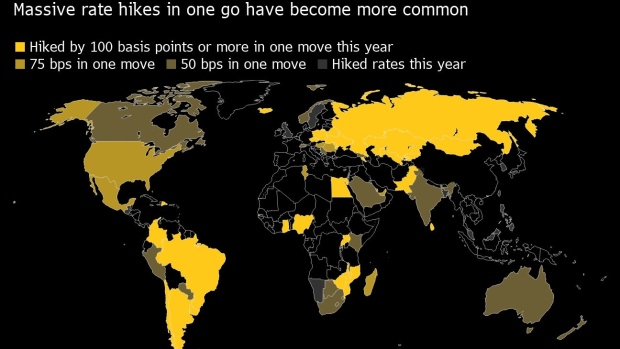

Policy makers around the world already have increased interest rates to battle record inflation that comes at the same time as the fallout from Russia’s invasion of Ukraine and lockdowns in China weigh on global growth. Some 70 central banks have raised borrowing costs and half of them -- including the US Federal Reserve -- have resorted to massive hikes of 75 basis points or more in one go.

The challenge for central banks will be to keep inflation in check while minimizing the impact on economic activity and decisive action probably is key, BIS General Manager Agustin Carstens told reporters.

“One strong result that we have obtained by our analysis of a soft versus a hard landing is that you are more likely to be on the soft landing side if you tighten in a timely and decisive fashion,” he said. “We have seen important developments in inflation, not only flare ups but a potential change in the dynamics of inflation.”

Overall, more needs to be done.

“Policymakers must press ahead with reforms to support long-term growth and lay the groundwork for more normal fiscal and monetary policy settings,” BIS said.

©2022 Bloomberg L.P.