Mar 26, 2024

Stan Wong's Top Picks: March 26, 2024

BNN Bloomberg

Stan Wong, portfolio manager at Scotia Wealth Management

FOCUS: North American Large Caps, ETFs

MARKET OUTLOOK:

Global equities are poised to mark their fifth consecutive month of gains, reflecting ongoing positive momentum in the markets. At The Stan Wong Group, our outlook for equity markets remains optimistic as we progress through the year. Forecasts indicate robust corporate earnings growth in the U.S., expected to exceed 10 per cent in 2024 and surpass 13 per cent in 2025. Notably, market breadth for global equities continues to strengthen, with over 75 per cent of constituents in the MSCI World Index now trading above their respective 200-day moving averages. Moreover, market participation has broadened beyond the technology and communications sectors, contributing to upward momentum across other sectors. Indeed, momentum in the technology sector has tapered off in recent weeks. However, over the near term, we advise a slightly guarded approach to equities due to prevailing overbought technical conditions. A temporary pause or consolidation for equities before the next leg higher is reasonably expected.

From a seasonality perspective, optimism prevails for equities in U.S. presidential election years under a first-term president. Since 1950, the S&P 500 Index has averaged a 12.2 per cent return during such years, without any instances of negative returns. Furthermore, historical data consistently demonstrates positive results in the second year of a bull market for the S&P 500 Index, boasting an average return of 13.5 per cent over 15 observations since 1950. Additionally, the widely tracked “January barometer” suggests a promising outlook, with historical data revealing that a positive January performance typically leads to an average return of 16.8 per cent for the full year, a trend observed also since 1950.

From a macroeconomic perspective, inflationary pressures are abating, with year-over-year (YoY) inflation in the U.S. now at 3.2 per cent, notably lower than the 9.1 per cent peak observed in 2022. Interest rates are showing signs of moderation, with the U.S. Federal Reserve signalling three rate cuts this year. In Canada, futures markets also indicate three rounds of cuts by the Bank of Canada before year-end. Such accommodative monetary conditions have historically provided a favourable backdrop for both equities and bonds. Lastly, the U.S. labour market remains robust, with the unemployment rate holding steady at 3.9 per cent.

In Stan Wong Managed Portfolios, our focus remains steadfast on identifying high-quality, secular growth companies to strengthen our portfolio mandates. We favour sectors such as health care, consumer discretionary, financials, and technology companies. Geographically, our equity allocation comprises approximately 58 per cent in U.S. equities, 27 per cent in Canadian equities, and 15 per cent in international equities. Within our fixed income allocation, we favour government and investment-grade corporate bonds with both short and medium durations. Overall, our strategic allocation aims to enhance returns while prudently managing risk for our clients.

- Sign up for the Market Call Top Picks newsletter at bnnbloomberg.ca/subscribe

- Listen to the Market Call podcast on iHeart, or wherever you get your podcasts

TOP PICKS:

With projected fiscal 2024 revenue of $5.8 billion, Dollarama is Canada’s largest discount retail store operator, boasting over 1,400 locations. We like Dollarama for its resilient business model, capitalizing on increasing consumer demand for value-priced goods. Over the years, the company has showcased operational efficiency and robust financial performance, characterized by consistent revenue growth and healthy operating margins. Last summer, Dollarama announced a share repurchase program for more than 13.6 million shares, underscoring management’s dedication to creating shareholder value. The company has a revenue growth rate of nearly 10 per cent over the past five years and plans to expand its store count to 2,000 locations. Looking ahead, Dollarama is forecasted to achieve an earnings growth rate of over 17 per cent over the next several years. From a technical standpoint, DOL shares have been steadily rising in an ascending pattern, with higher highs and higher lows.

NOVO-NORDISK A/S ADR (NVO NYSE)

Headquartered in Denmark, Novo-Nordisk is a leading global healthcare company with nearly US$42 billion in forecasted fiscal 2024 revenue. As Europe’s most valuable listed company by market capitalization, Novo Nordisk leads the global market in diabetes care and obesity treatment drugs, supplying half of the world’s insulin and commanding one-third of the diabetes treatment market. With more than 36 million people worldwide benefiting from Novo Nordisk’s drugs, the company is experiencing unprecedented growth, driven by continued consumer demand for blockbuster medications Ozempic, for diabetes treatment and Wegovy, for weight loss. Promising cardiovascular health benefits from these drugs is further expected to drive sales growth in the coming years. From a technical perspective, NVO shares have been outpacing the broader market indices since early 2017, maintaining a steady yet robust upward trend. Looking forward, Novo Nordisk is poised to deliver annual earnings per share growth rate of over 18 per cent in the coming years.

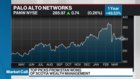

PALO ALTO NETWORKS INC (PANW NASD)

With projected fiscal 2024 revenue of about US$8 billion, Palo Alto Networks is one of the world’s largest cybersecurity providers, offering cloud-based subscription services across data centers spanning the Americas, Europe, and Asia. Primarily catering to medium to large enterprises, service providers, and government entities, Palo Alto Networks is strategically positioned to capitalize on strong secular trends, driven by escalating cyber threats globally, the expanding digital transformation landscape, and the significant costs incurred by security breaches. The accelerating adoption of remote work trends, Internet of Things (IoT), and ongoing cybersecurity innovation should further drive future growth for the company. From a technical perspective, PANW shares have been trending higher, trading above ascending 200-day and 200-week moving averages. Palo Alto Networks is forecasted to achieve an annual earnings growth rate of over 20 per cent over the next several years.

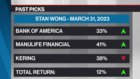

PAST PICKS: MARCH 31, 2023

BANK OF AMERICA (BAC NYSE)

Then: US$28.60

Now: US$36.89

Return: 29 per cent

Total Return: 33 per cent

MANULIFE FINANCIAL (MFC TSX)

Then: $24.80

Now: $33.10

Return: 33 per cent

Total Return: 41 per cent

KERING (PPRUY OTC)

Then: US$65.14

Now: US$39.15

Return: -40 per cent

Total Return: -38 per cent

Total Return Average: 12 per cent

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| BAC NYSE | Y | Y | Y |

| MFC TSX | Y | Y | Y |

| PPRUY OTC | N | N | N |