May 31, 2023

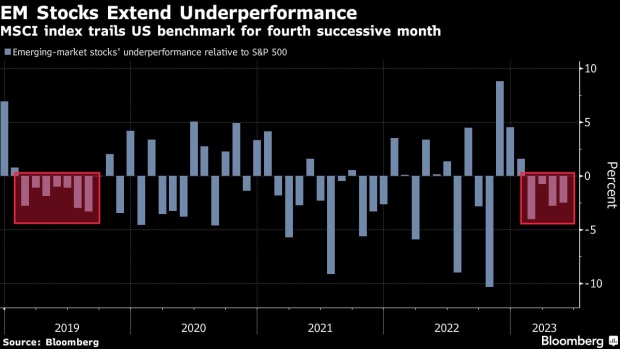

Stocks in EM Slip to Worst Underperformance Since 2019 Trade War

, Bloomberg News

(Bloomberg) -- Stocks in the developing world haven’t had such a bad run since the height of the US-China trade war four years ago.

The MSCI Emerging Markets Index is not only heading for a decline in May, but is also poised for a fourth successive month of underperformance against developed-market equities in general, and the S&P 500 Index in particular. That’s the longest streak since 2019, when the gauge trailed its peers for eight successive months through September a time when Washington and Beijing were deadlocked over restrictive tariffs.

Despite stellar equity rallies in Latin America and in the semiconductor sector, the broader emerging-market performance is lagging behind because of growth risks in Asia and political uncertainty in emerging Europe, Middle East and Africa. As China’s recovery falters and policy flipflops continue, heavyweight technology stocks in Hong Kong are missing out on the rally by their US peers. Ten out of 11 industry subgroups in the developing nation benchmark have dropped in May, led by property and commodity stocks.

The MSCI index is heading for a 1.7% loss in May, while the S&P 500 is poised for a 0.9% gain. The Hang Seng Tech Index is down 7%, compared with an 8.4% advance in the Nasdaq 100.

READ MORE: Stock Bulls Focus on Latin America as Emerging-Market Rifts Grow

The underperformance has dragged the emerging-market index to a forward price-earnings ratio of 11.7 times, down from 12.4 in January. That marks a valuation discount of 37% to US stocks and 29% against the broader developed-market universe. Both relative valuations are the lowest since November.

Earnings forecasts suggest a choppy road ahead for emerging-market stocks. For the next 12 months, equity analysts remain pessimistic on corporate performance in poorer nations, cutting their average forecast by 0.7% this year. In contrast, estimates for developed markets have steadied and started rising.

©2023 Bloomberg L.P.