Apr 27, 2022

Tech rebounds in late trading on surge in Meta

, Bloomberg News

Peak earnings growth is likely behind us: Invesco’s Talley Leger

U.S. equities rebounded from the worst rout since March, though ended well off session highs as a glut of earnings reports whipsawed sentiment.

Dip buyers powered the S&P 500 as much as 1.6 per cent higher before a late-session rally left it higher by just 0.2 per cent. The rally picked up in aftermarket trading as strong user numbers powered Meta Platforms Inc. to a 13 per cent surge as of 4:15 p.m. in New York. Ford Motor Co., Pinterest Inc. and Qualcomm also advanced on solid results, helping lift the biggest ETF that tracks the Nasdaq 100 by almost 1 per cent. The underlying index edged lower in cash trading.

The late advance did little to soften what is shaping up to be the worst month for the S&P 500 since March 2020 as the Federal Reserve’s campaign to tamp down inflation forced investors to reprice risk assets. Europe’s energy crisis, China’s struggle to suppress COVID and the war in Ukraine also combined to drive major bourses in Europe and the U.S. to their lowest since mid-March this week.

“After some disappointing earnings news, investors seem to be acknowledging that the combination of higher input costs -- driven by supply chain snarls and higher inflation, alongside a Fed committed to tightening financial conditions -- may warrant an adjustment in expectations,” said Cliff Hodge, chief investment officer for Cornerstone Wealth. “Valuations, margins and earnings expectations are all ripe to be cut, especially if Big Tech disappoints this quarter.”

The ICE U.S. dollar index rose to a five-year high, while the euro touched the weakest level versus the greenback since 2017 as Russia said it will stop natural gas flows to Poland and Bulgaria. European gas prices surged as traders weighed the risk of other countries being hit next, spurring worries over a further spike in inflation and a sharp slowdown in the economy.

Fears that the Fed would tip the world’s largest economy into a recession have plagued markets all week, all while activity slows in China as COVID lockdowns bite. Treasuries retreated but the 10-year yield, at about 2.84 per cent, remains lower for the week. Gold fell 1 per cent.

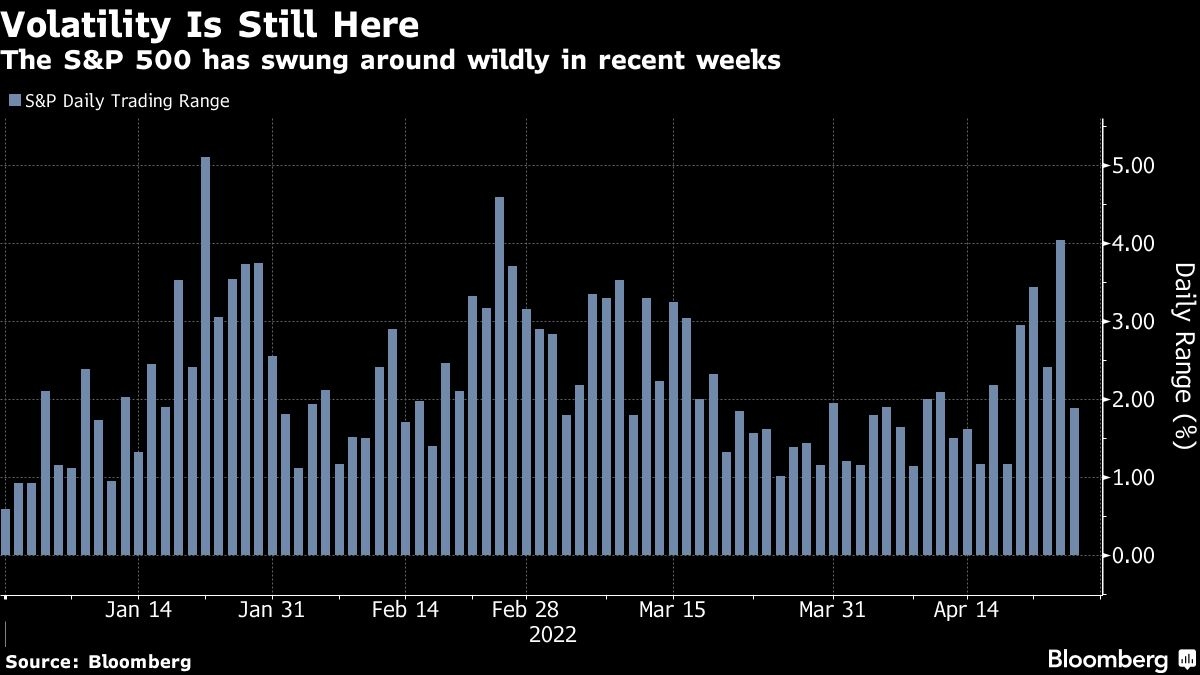

“The markets are confused. The uncertainty factor is some of the highest we’ve seen in the course of the last number of years,” Kate Moore, BlackRock global allocation team head of thematic strategy, said in a Bloomberg Television interview, citing everything from inflation, COVID, central bank policy to war in Ukraine. “There are so many crosscurrents. And against that backdrop, it’s hard to see volatility come down dramatically.”

Also helping the sentiment today was China’s President Xi Jinping’s vow for more infrastructure projects -- the latest step to support a lockdown-hit economy.

Twitter Inc. declined, extending losses as shares dropped further below Elon Musk’s offer price of US$54.20 per share. Tesla Inc. advanced after slumping on Tuesday.

Events to watch this week:

- Tech earnings include Meta Platforms, Amazon, Apple

- EIA oil inventory report, Wednesday

- Bank of Japan monetary policy decision, Thursday

- U.S. 1Q GDP, weekly jobless claims, Thursday

- ECB publishes its economic bulletin, Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.2 per cent as of 4 p.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average rose 0.2 per cent

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.5 per cent

- The euro fell 0.7 per cent to US$1.0559

- The British pound fell 0.2 per cent to US$1.2546

- The Japanese yen fell 0.8 per cent to 128.31 per dollar

Bonds

- The yield on 10-year Treasuries advanced 10 basis points to 2.82 per cent

- Germany’s 10-year yield declined one basis point to 0.80 per cent

- Britain’s 10-year yield advanced two basis points to 1.81 per cent

Commodities

- West Texas Intermediate crude rose 0.4 per cent to US$102.12 a barrel

- Gold futures fell 0.9 per cent to US$1,886.50 an ounce