Dec 15, 2023

Success Abroad Drives Rare Winners in Dismal China Stock Market

, Bloomberg News

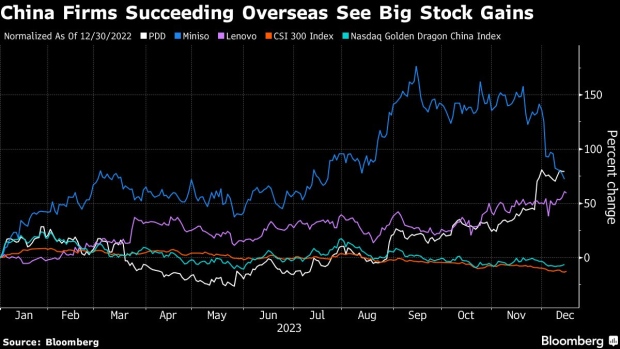

(Bloomberg) -- In a year when Chinese stocks are among the worst-performing globally, there have been rare winners: those that have shown they can compete on the global stage.

Take PDD Holdings Inc. Its US-listed shares have surged 80% this year as its Temu discount shopping app quickly grew into a legitimate Amazon.com Inc. challenger after a splashy Super Bowl ad in February. Budget lifestyle retailer Miniso Group Holding Ltd., which opened a flagship store in Times Square in May, is up by more than 70% amid record sales and profits.

Jack Ma’s Biggest E-Commerce Rival Is Coming for Amazon, Walmart

Such successes have been rare in China, with its benchmark stock gauge on track for an unprecedented third-straight year of losses. As uncertainty remains over the domestic economy heading into 2024, a number of market veterans think international prowess will continue to lift shares of select companies.

“For many sectors, the domestic Chinese market has become a red ocean, and there is a visible corporate mindset change where more are thinking about global growth opportunities,” said Daisy Li, a fund manager at EFG Asset Management HK Ltd. “Making inroads overseas can be easier for those whose products and execution have withstood the intense competition at home.”

Going Global

Global inflation is seen helping forays abroad by Chinese companies that offer competitive products at attractive prices. PDD is a prime example, having leveraged the success of its Pinduoduo app at home to create Temu for an overseas audience. So is Miniso, which has built a network of over 2,000 stores overseas based on its popular low-priced domestic formula.

Most Chinese companies rely more on domestic sales than peers in developed markets. MSCI China Index members generate just 14% of sales from foreign sources, according to analysis from Societe Generale SA.

China’s ongoing property crisis and weak consumer spending have fueled price wars that crimp earnings, motivating companies from electric vehicle makers to bubble tea chains to try their hands abroad. The nation’s largest EV maker BYD Co. posted record profit for the third quarter, thanks partly to growth in exports.

“It’s not just BYD — for all the Chinese car makers, if they can, they definitely want to have more overseas sales exposure,” said Ming Lee, head of Greater China auto research at BofA Securities. “First, there is a clear need to diversify single-market risk and second, overseas sales boost profitability as the same models sold overseas are usually charged around 40-60% higher than their domestic pricing.”

Stock Picks

BofA has chosen 22 Chinese stocks that it sees as offering upside potential as a result of their global presence. Listees including PDD and PC maker Lenovo Group Ltd. have posted high-double-digit percentage gains in 2023, while other including mainland-listed shares of BYD and battery-maker Contemporary Amperex Technology Co. have underperformed.

Morgan Stanley says overseas exposure was a key driver of valuations in the Chinese consumer sector in 2023, and that this should continue next year amid the uncertain macro outlook. The brokerage highlights clothing manufacturer Shenzhou International Group Holdings Ltd. and toymaker Pop Mart International Group Ltd. as stocks that should benefit.

Shein’s IPO Plan to Fuel Scrutiny Over Cotton, China Roots

Societe Generale acknowledges there are risks from geopolitical trade barriers, such as those faced by Chinese EV makers in Europe, and adds that the weak yen might boost the attractiveness of some Japanese machinery versus China products. Still the broker notes Chinese stocks with large overseas sales exposure, such as smartphone maker Xiaomi Corp., have been outperforming.

Goldman Sachs Group Inc. expects going global will present the next key growth drivers for China internet companies, “given the increasingly mature domestic e-commerce and games markets at high online penetrations,” analyst Ronald Keung wrote in a recent note.

©2023 Bloomberg L.P.