Dec 20, 2022

Surprise BOJ Move Will Help Ease Japan’s Mounting Energy Crisis

, Bloomberg News

(Bloomberg) -- The Bank of Japan’s latest policy shock will provide some relief to the nation’s energy crisis, helping to cut the cost to procure fuel from overseas.

BOJ Governor Haruhiko Kuroda’s surprise decision to widen the trading band on 10-year bond yields triggered the biggest one-day jump in the yen in over two decades. The stronger yen is bound to benefit the nation’s power producers, gas distributors and refiners, which have grappled with surging fuel costs due to the rapidly devaluing currency and global energy crunch.

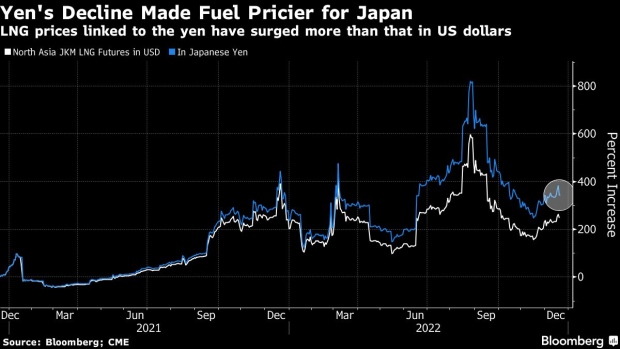

The weak yen turbocharged Japan’s energy import bill, complicating efforts to stockpile fuel and avoid shortages or blackouts. Liquefied natural gas prices in yen terms have more than quadrupled in the last two years, compared to a threefold increase when pegged to the dollar.

“In the short term, yen’s appreciation will most likely benefit Japanese refiners and energy importers because it will reduce the costs of buying oil, LNG and other US dollar-denominated fuels,” said Will Sungchil Yun, senior commodities analyst at SI Securities.

LNG prices rallied to a record earlier this year after Russia’s invasion of Ukraine upended markets, and forced some smaller Japanese importers to curb purchases of the super-chilled fuel from the spot market. To be sure, energy importers may hold off on additional purchases if they expect the yen to strengthen further.

“The rapid devaluation of the Japanese currency seen in the recent period had certainly damaged Japanese LNG procurement,” said Hiroshi Hashimoto, a Tokyo-based analyst at the Institute of Energy Economics, Japan.

While the government will provide temporary subsidies for household power bills next year, electricity rates have surged in the last year and are at risk of rising further due to the mounting fuel costs. That contributed to inflation in Japan jumping to a four-decade high.

(Updates with analyst’s comment in the fourth paragraph.)

©2022 Bloomberg L.P.