Jul 31, 2022

Taiwan Dollar Falls to Lowest in Two Years as Economy Suffers

, Bloomberg News

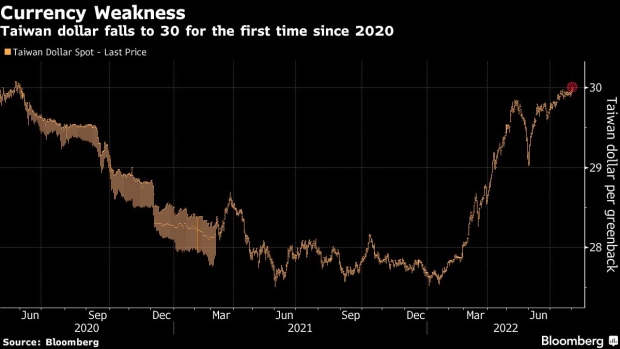

(Bloomberg) -- The Taiwan dollar slid past a key psychological level of 30 per US dollar for the first time since June 2020 amid bleak economic prospects for the island.

The currency fell as much as 0.2% to 30.008 per dollar amid foreign outflows that reached $626 million this quarter. Taiwan last week lowered its unofficial economic outlook for the year amid waning global demand for electronics and rising inflation. Asia’s factories continued to report weakening activity in July amid lingering supply chain complications and a slowing global economy.

Investor sentiment is also cautious amid geopolitical risks surrounding a potential visit by Nancy Pelosi to the island. Pelosi left Taiwan out of the itinerary in a statement on Sunday announcing the trip, which will also include stops in Japan, South Korea and Malaysia. Yet speculation is still rife that Pelosi would visit Taiwan at some point this week, risking a heavy-handed response from China, which regards the self-governing island as its territory.

“The underperformance in the Taiwan dollar is reflecting heightened geopolitical risk, rather than fundamentals,” Frances Cheung, rates strategist at Oversea-Chinese Banking Corp. in Singapore. “Unfortunately this kind of sentiment appears to be self-fulfilling in that the resulting equity outflows are putting pressure on the local currency.”

©2022 Bloomberg L.P.