Jul 5, 2022

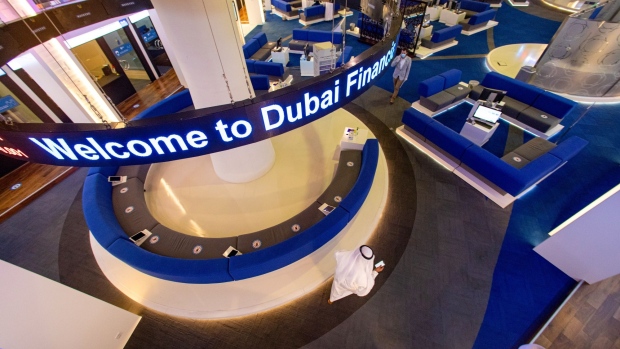

Tecom’s Muted Dubai Debut Signals Waning Demand for Gulf IPOs

, Bloomberg News

(Bloomberg) -- Sign up for our Middle East newsletter and follow us @middleeast for news on the region.

Tecom Group traded unchanged in Dubai after raising $454 million in its initial public offering, in another sign of waning investor appetite for Gulf listings.

The stock opened at 2.67 dirhams Tuesday, at the same price Dubai’s government last month sold 625 million shares. The IPO was priced at the top end of the range.

While the Middle East had so far been a bright spot in an otherwise gloomy market for new share sales, Tecom’s muted open adds to signs that demand for risky assets has tapered. Saudi Arabia’s Al Othaim family on Sunday scraped plans to sell shares in its malls business.

Investors snapped up all shares in Tecom hours after the firm opened books. But despite being covered 21 times, the IPO proved less popular than some recent listings -- Dubai Electricity & Water Authority was 37 times oversubscribed, excluding cornerstone and strategic investors, while specialty plastics maker Borouge’s IPO was about 42 times oversubscribed.

Dubai’s Tecom Draws $9.6 Billion in Orders for $454 Million IPO

Tecom is the second of 10 planned privatizations in Dubai as part of the city’s plans to bolster its capital markets. Dubai Electricity & Water Authority’s $6.1 billion share sale was the first, and Bloomberg News has reported that a float of the city’s road-toll system is set to follow after the summer. Supermarket operator Union Coop is also planning to list shares later this month.

Read More: Middle East May Be Next in Brutal IPO Downturn Wave

Tecom houses more than 7,500 companies and 10 large business complexes including Dubai Internet City and Dubai Media City. Its customers include Microsoft Corp., Alphabet Inc.’s Google and Meta Platforms Inc.’s Facebook. The listing comes as Dubai’s property values have surged, with increases topping those of every other major city last year, according to Knight Frank.

Emirates NBD Bank, First Abu Dhabi Bank, Goldman Sachs Group Inc., Morgan Stanley and UBS Group AG were the joint global coordinators and joint bookrunners for the IPO.

©2022 Bloomberg L.P.