Jun 8, 2023

Tesla’s Non-Chinese Battery Makers Outperform on US Tax Breaks

, Bloomberg News

(Bloomberg) -- With Tesla Inc. shares climbing back to a seven-month high amid a string of positive news, Asia investors are focusing on its all-important battery suppliers, especially those outside China.

Panasonic Holdings Corp. and LG Energy Solution Ltd. are likely to benefit the most from tax credits under the Inflation Reduction Act, Citigroup Inc. analyst Kota Ezawa wrote in a report. One of the main goals of the IRA is to make the US less reliant on China, which dominates the EV battery supply chain.

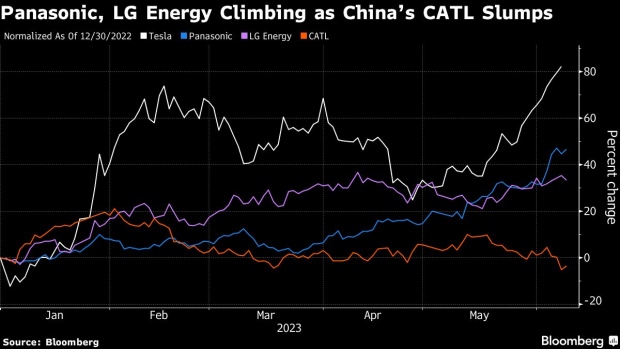

Panasonic shares have climbed 45% so far this year in Tokyo, while LG Energy is up 36%. Both are outpacing gains in their local benchmarks, though they’re still trailing Tesla’s 82% surge. Rival Chinese battery maker Contemporary Amperex Technology Co. has missed out on the rally completely, down 4.5%.

Tesla Rides Tech Rally to 7-Month High as Good News Piles Up

Industry expert Chris Berry estimates total IRA credits could reach $1 trillion versus the initial Congressional Budget Office estimate of $369 billion over 10 years, according to the Citi note.

Berry told a Citi seminar that China’s dominant share of the refining market is “an obstacle to IRA mechanisms working, and that various ideas to build a US-led scheme to reduce dependency on China were being considered,” Ezawa wrote.

To qualify for the tax credit, a big chunk of the components and raw materials in a vehicle’s battery must be sourced in America or from countries that have free-trade agreements with the US.

CATL slumped 9% over the first three days of this week as pundits warned about the IRA impact. The Chinese company responded by saying its relationship with Tesla is “unchanged and will continue to deepen.” Bloomberg has previously reported Tesla is looking to build a battery plant in the US with CATL.

Citi isn’t ready to count CATL out either. Tesla hasn’t moved to stop using the Chinese maker’s batteries as of yet, and they may even still qualify for US tax benefits, the broker says.

Tesla’s Tax Win Piles Pressure on China’s Top Battery Maker CATL

“The details of the IRA requirement are still uncertain,” but as long as Tesla makes sure that the average percentage requirement for North American content is met, “it is possible to use some CATL batteries and still be eligible for the full credit,” analyst Jack Shang wrote in a separate note.

Still, investors seem to be gravitating toward the non-Chinese stocks. LG Energy has been the third most-bought Korean stock among foreign investors this week, after the nation’s chip giants. CATL meanwhile has seen the greatest outflow of funds from Hong Kong and overseas this week among Shenzhen-listed stocks.

--With assistance from April Ma.

©2023 Bloomberg L.P.