Apr 27, 2023

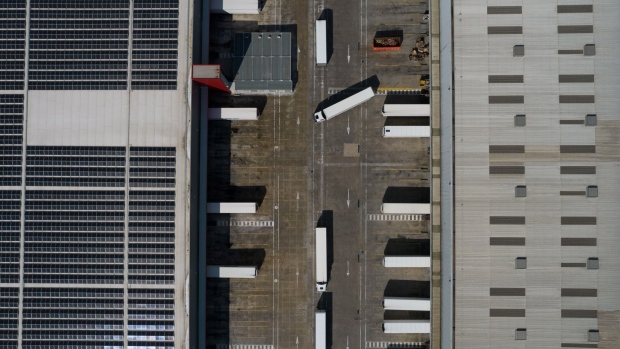

Texas Teacher Pension Considers $1.5 Billion Bet on Warehouses

, Bloomberg News

(Bloomberg) -- The Teacher Retirement System of Texas is considering a $1.5 billion investment in the warehouse business.

The TRS board approved Thursday the proposed investment to Bridge Industrial, a closely held real estate firm focused on warehouses. TRS declined to elaborate on the potential commitment.

The state’s largest pension had $173 billion assets under management as of September, and real estate accounted for about 17% of total investments.

Warehouse space is still seen as one of the more attractive investments in commercial real estate, which has been hit by higher interest rates.

Growth in the e-commerce industry has been driving demand for warehouse space. Blackstone Inc. is one of the biggest players in the business and spent about $1 billion in the last few months of 2022 to acquire industrial spaces globally. In December, the firm agreed to buy six industrial properties in Toronto from the asset management arm of Toronto-Dominion Bank.

Over the past few years, pensions have increased their exposure to US real estate investment trusts that specialize in industrial properties. Investment in industrial REITs were up 103% from December 2019 to April 2022, according to a report by S&P Global.

In 2021, Bridge Industrial and the Canada Pension Plan Investment Board announced a joint venture to develop industrial properties in supply-constrained market across the US. The two entities allocated $1.1 billion to the joint venture with CPP owning a 95% stake.

Bridge was founded in 2000 to focus on the development and acquisition of industrial properties in the US and UK, according to its website.

--With assistance from Natalie Wong and Craig Giammona.

©2023 Bloomberg L.P.