Mar 23, 2021

Thai Rates Seen on Hold, GDP Forecast Likely Cut: Decision Guide

, Bloomberg News

(Bloomberg) -- Thailand’s central bank will likely keep its key interest rate unchanged on Wednesday at an all-time low to save limited policy space while also cutting its growth forecast for the year.

All 25 economists surveyed by Bloomberg expect the Bank of Thailand to keep the policy rate at 0.5% for a seventh consecutive meeting, after lowering it by a total of 75 basis points last year. The bank is also scheduled on Wednesday to offer its latest estimate for 2021 gross domestic product.

With the central bank on pause, fiscal policy has been doing the heavy lifting to support a fragile recovery after the economy contracted 6.1% last year. The Finance Ministry and the state planning agency earlier cut their own 2021 growth forecasts because of a surge in Covid-19 infections earlier this year and the slow return of foreign tourism.

“We expect rates to remain on hold this year, with the onus on fiscal policy” to drive growth, said Radhika Rao, an economist at DBS Bank Ltd. in Singapore. “The ongoing domestic vaccine rollout and plans to lower inbound quarantine requirements also lend optimism that tourism, as well as other contact-intensive services, might witness some relief in the second half.”

Here’s what to watch for in Wednesday’s policy decision:

Growth Outlook

The central bank is expected to cut its forecast for gross domestic product from the 3.2% it predicted in December. Governor Sethaput Suthiwartnarueput signaled last month that this year’s GDP growth would be around “high 2%,” with the recovery expected to be “slow and uneven.”

What Bloomberg Economics Says...

“Higher debt burdens for households and businesses make more cuts less effective, and the end of the pandemic draws nearer with each Covid-19 jab.”

-- Tamara Mast Henderson, Asean economist

To read the full note, click here.

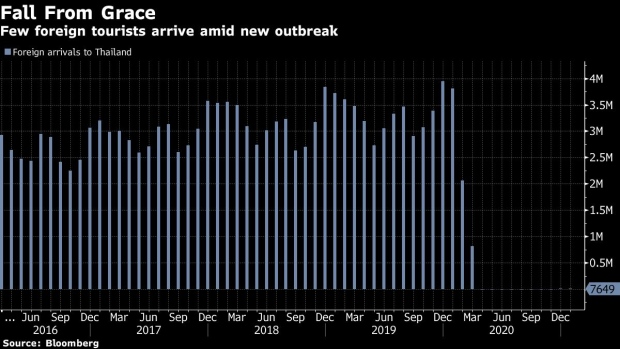

The central bank is also expected to lower its forecast for tourist arrivals from the 5.5 million predicted in December. Only 6.7 million foreign tourists entered Thailand last year, a fraction of the 40 million visitors in 2019, who generated more than $60 billion in revenue.

Fiscal Lead

The central bank will likely reiterate the need for continued fiscal stimulus and its readiness to use additional monetary policy tools if needed.

The government on Tuesday approved steps to help businesses affected by the outbreak, including 250 billion baht ($8.1 billion) of soft loans and 100 billion for a program allowing cash-starved companies to park their assets with lenders in exchange for credit.

Baht Moves

Concerns about baht strength have eased in recent months amid rising U.S. bond yields. The baht has dropped 3.3% against the dollar so far this year, compared with its 5.8% rise in the last quarter of 2020. Still, the central bank will likely remain vigilant on the currency given the importance of exports to any economic recovery.

In minutes of its February meeting, the Bank of Thailand reiterated that any rapid appreciation in the baht could affect the economy and said it considered whether additional measures were needed to make sure exchange-rate movements don’t hinder the recovery.

©2021 Bloomberg L.P.