Dec 22, 2022

The 60/40 Portfolio Is Set for a Comeback Next Year, BofA Says

, Bloomberg News

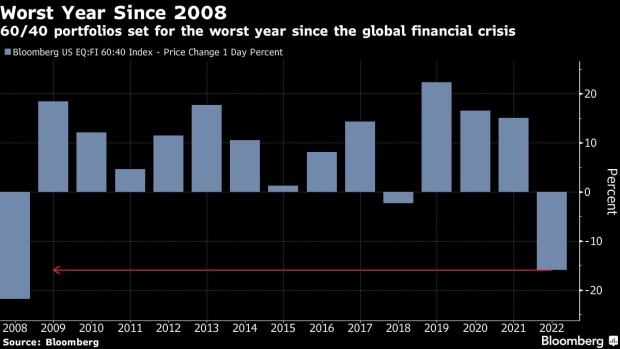

(Bloomberg) -- The widely followed 60/40 portfolio is set for a recovery after experiencing its worst year since the global financial crisis, according to Bank of America Corp.’s chief investment strategist.

Putting 60% in stocks and 40% in bonds “should generate a positive return in 2023,” Michael Hartnett said in a year-ahead outlook published by the bank on Thursday.

Hartnett is bullish on bonds in the first half of next year as he expects a recession to last through the first six to nine months, without being deep or scarring. The stock market will grind higher in the second half once it’s “clear that we’re past the peak in interest rates and the trough in corporate profits,” he said.

Global bonds and stocks were hammered in tandem this year as central banks hiked interest rates, fueling fears of a recession. A Bloomberg benchmark that measures cross-asset market performance in the US shows a typical 60/40 portfolio is set for the worst year since the global financial crisis.

Will the 60/40 Portfolio Stage a Comeback in 2023?

Hartnett also said the outlook for small-cap stocks is “really quite good” once investors begin anticipating a recovery.

“We’re not going back to a world of 0% rates or quantitative easing in which all you had to do was own big tech stocks,” he said. “People are looking for new leadership in the markets, and small-cap stocks will be part of that.”

©2022 Bloomberg L.P.