Nov 6, 2022

The All-Male Board Is Making a Swift Comeback in Australia

, Bloomberg News

(Bloomberg) -- All-male boards have quietly returned to Australia’s benchmark stock index.

Four mining firms recently added to the S&P/ASX 200 have zero women on their boards, data from Bloomberg and the Australian Council of Superannuation Investors show. That’s a setback for the index, which only last year reached a milestone of having no firms without female board members.

Capricorn Metals Ltd., Core Lithium Ltd. and Sayona Mining Ltd. have no woman directors, and all of their senior executives are men as well, according to their websites. The lone female director at De Grey Mining Ltd. resigned last month; there are two women on its executive team of 10.

“Once again, there are zero-women boards among the country’s largest listed companies,” said Louise Davidson, chief executive officer of ACSI, which engages with firms on behalf of pension funds. “Those companies promoted into the ASX 200 have a year’s grace before we apply our ‘vote against’ policy to them, but we will be engaging strongly with them in the meantime.”

The bulk of ASX 200 boards with the least women are in the mining industry, which faces increasing pressure from investors to act on environmental, social and governance issues ranging from fossil fuels to its treatment of women. An inquiry this year uncovered dozens of cases of sexual harassment and abuse of female workers at listed firms including BHP Group and Rio Tinto Group.

In a statement on its website, Capricorn Metals says its board “is committed to workplace diversity, with a particular focus on supporting the representation of women at the senior level of the company and on the board.” The company, along with Core Lithium and Sayona Mining, didn’t reply to requests for comment.

De Grey Mining’s last female board member Samantha Hogg resigned last month. A statement at the time said the board was “conscious of its diversity requirements” under corporate governance requirements in its search for a replacement.

Voting Power

Australian pension funds, which are publicly championing ESG issues as their members become increasingly choosy about where their retirement savings are invested, are among some of the biggest shareholders in mining firms including those with all-male boards.

Host-Plus Pty, which oversees about A$89 billion ($57 billion) of assets, voted against both the election of a male candidate seeking a board role at Capricorn Metals and the re-election of a male board member at De Grey Mining due to gender diversity concerns, it said in an e-mailed statement.

REST Super, a A$65 billion fund that’s also a Capricorn Metals investor, said: “We are an active owner and believe that engaging with companies as a shareholder on ESG risks, including appropriate gender representation on boards, is an effective way of protecting members’ interests.”

Aware Super Pty, with about A$150 billion of assets, voted against the re-election of directors “at a number of companies including Core Lithium” in the past financial year on diversity concerns, a spokesperson said in an e-mailed statement.

Women are underrepresented in key decision-making roles across almost the entire workforce, according to Australia’s Workplace Gender Equality Agency. While they made up half of all employees last year, they comprise only 19.4% of CEO roles and a third of key management positions. When it comes to boards, 33% include women and only 18% of chairs are female.

“The fact is that diversity brings material benefit to governance outcomes and strengthens decision-making,” said Davidson. “It helps prevent ‘group think’ and promotes better performance over the long-term.”

Slow Progress

Women held 11 more seats on company boards in the third quarter of this year, compared with the previous three-month period, according to Bloomberg data. The average number of female directors rose from 2.6 to 2.7. The average size of a board was 7.5 people.

- Two companies - IDP Education Ltd. and Nufarm Ltd. - surpassed the 30% target for female board membership for the first time since at least January 2019. The number of those above the threshold rose to 133 in September

- The Bloomberg Gender-Equality Index returned -9.5% in September, under performing the MSCI World Index, which returned -9.3%

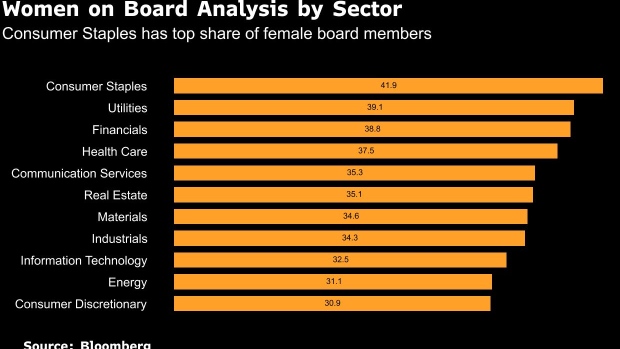

- The percentage of female directorships increased to 35.3% from 34.8%

- That’s above the 31.9% of women on boards of the S&P 500 in the U.S., 14.6% of the Nikkei 225 in Asia and 17.1% of the Hang Seng in Asia and below the 38.8% of the Stoxx 600 in Europe

- Seventeen S&P/ASX 200 companies increased the number of women on their boards; the top by market value were Fortescue Metals Group Ltd, Sonic Healthcare Ltd. and Cochlear Ltd.

- Eight companies reduced the number of female directors; the biggest by market value were Commonwealth Bank of Australia, Fisher & Paykel Healthcare Corp. and Northern Star Resources Ltd.

ASX 200 companies with the highest and lowest percentage of female board members:

The Bloomberg analysis is based on data that covers 193 companies in the S&P/ASX 200. Historical analysis may be impacted by changes to the index membership, while monthly board changes may be considered effective at month’s end.

The Bloomberg Gender-Equality Index is a modified capitalization-weighted index that tracks the financial performance of those companies committed to supporting gender equality through policy development, representation and transparency.

To see the percentage of women on a company board: FA ESGG

To see more on Bloomberg Gender-Equality Index: GEI

To see more on Bloomberg’s ESG fields and sustainable finance solutions: BESG

©2022 Bloomberg L.P.