Apr 18, 2019

Tiny Rise in Japan’s Inflation Leaves It Well Below BOJ’s Goal

, Bloomberg News

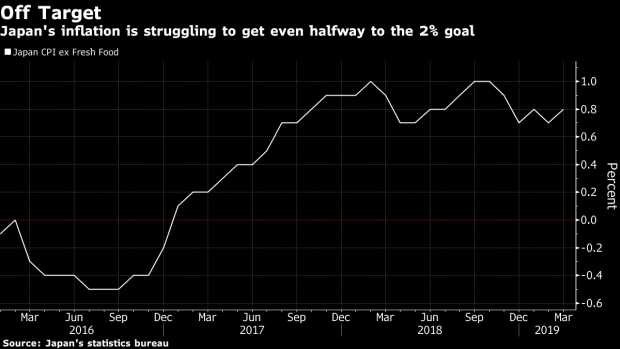

(Bloomberg) -- Japan’s key inflation gauge inched higher before an expected downturn in price pressures later this year adds to challenges facing the central bank.

Consumer prices excluding fresh food rose 0.8 percent in March from a year earlier, compared with a 0.7 percent median forecast of economists, data from the ministry of internal affairs showed Friday.

Key Insights

- Friday’s data provide the last key economic indicator before Bank of Japan’s board meet April 24-25 to consider policy and quarterly forecasts for growth and inflation. The BOJ is widely expected to keep policy unchanged but most analysts see a chance of downgrades to its projections for the economy and prices.

- Inflation is likely to slow as free education for younger children takes effect in October and as mobile phone carriers lower fees.

- NTT Docomo Inc. this week unveiled a plan to cut prices as much as 40 percent. BNP Paribas SA estimates lower phone charges will trim about 0.3 percentage points from consumer prices excluding fresh food.

- Senior lawmakers including the finance minister have signaled that they don’t think the BOJ has to push for 2 percent inflation at all costs and that it can be more flexible in pursuing the goal. Stronger inflation could hurt the government’s popularity before an election in July and a sales-tax hike in October.

What Bloomberg’s Economist Says

“Downward pressure from lower mobile phone service charges and reduced education costs should weigh on inflation. These factors may give the BOJ an excuse for continued slackness in inflation despite extreme monetary easing.”

Bloomberg EconomicsClick here to read more

Get More

- Overall, Japan’s consumer prices rose 0.5 percent in March, matching economists’ forecast.

- Stripping out energy and fresh food, consumer prices climbed 0.4 percent, also in line with a gain predicted by analysts.

To contact the reporter on this story: Toru Fujioka in Tokyo at tfujioka1@bloomberg.net

To contact the editors responsible for this story: Brett Miller at bmiller30@bloomberg.net, Henry Hoenig

©2019 Bloomberg L.P.