Jul 12, 2022

Top Performing Emerging Market Fund Sounds Alarm on Debt Defaults

, Bloomberg News

(Bloomberg) -- More debt defaults are going to roll across emerging markets because countries can’t cope with the sudden increase in borrowing costs, according to Man Group, which runs one of the best-performing funds in the industry.

About 10% of dollar-denominated sovereign debt is at a high risk of default, said portfolio manager Lisa Chua in an interview with Bloomberg. Russia and Sri Lanka have already defaulted this year, and there’s now a record 19 developing countries with sovereign debt trading at distressed levels.

Chua, part of a five-person emerging market debt team led by Guillermo Osses that’s beaten 99% of peers this year, said the fund was able to avoid some of the risks from Russia’s war in Ukraine and steered away from crowded areas of the market.

“Not everyone will be able to roll over their debt in an environment of less abundant liquidity,” said Chua. “We do expect to see more defaults and potential restructurings.”

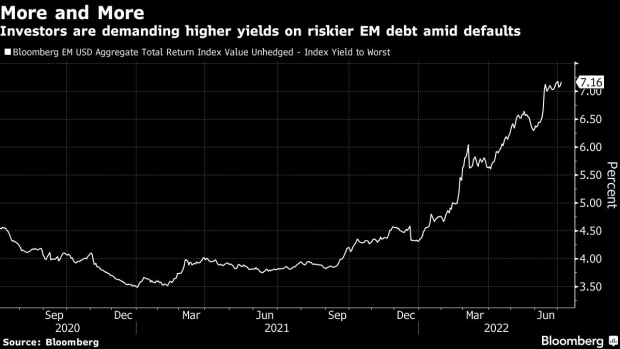

The number of nations with debt yields that indicate investors believe default is a real possibility has more than doubled in the past six months, according to data compiled from a Bloomberg index. At stake is $237 billion due to foreign bondholders, with the market’s focus on countries such as El Salvador, Ghana and Pakistan.

“High-yield, frontier markets that have issued more recently in that grab for yield are at risk,” said Chua. “It is worth pricing in more default risk than is currently priced in the market.”

Emerging Market Bonds Face $237 Billion Cascade of Defaults

Man, the world’s largest publicly-listed hedge fund with $151.4 billion under management, topped 99% of its peers with its emerging-market debt fund returning 4.7% this year, according to data compiled by Bloomberg. By contrast, a Bloomberg index shows emerging-market sovereign dollar debt lost 20%.

While Chua declined to talk about the fund’s performance for legal reasons, she implied in a recent blog that the firm may have dodged the pain felt by holders of Russia’s debt after its invasion of Ukraine, pointing to how the country’s weak ESG governance metrics, rich valuations and overcrowded positioning by other players were all potential red flags for Man.

“These issues were warning signs to us early on of potential risk on the ESG side and these risks took center stage as Russia started amassing troops at the border of Ukraine in the months before the invasion,” she wrote. “If market participants were truly concerned about downside risk related to an invasion, they should have also been decreasing positions in Ukraine, but that wasn’t the case.”

Following the effects of the invasion, from higher inflation to food supply disruptions, countries with pegged or heavily managed currencies may now struggle to adjust to economic shocks to pay back external debt, Chua said.

Recession Angst Spurs Pivot to Emerging World’s Growth Engines

Such concerns have already led investors to pull $48 billion from global emerging-market debt funds in the first half of 2022, according to Bank of America Corp. citing EPFR Global data. For the coming months, Chua is cautious, but sees opportunities to add higher-quality assets if default fears cause a broad selloff.

The yields offered on riskier emerging-market debt are already at a two-year high, giving investors 1% for every month for taking the risk. Major economies from Mexico and Brazil to Indonesia have also withstood the turbulence so far.

“The focus needs to be on risk reward, mitigating downside risk, and not just blindly buying beta and yield,” Chua said. “We are entering a new regime where investors need to be much more focused on alpha generation, country selection.”

©2022 Bloomberg L.P.