May 24, 2023

Traders Ramp Up Bets on Japan Inflation to Highest This Year

, Bloomberg News

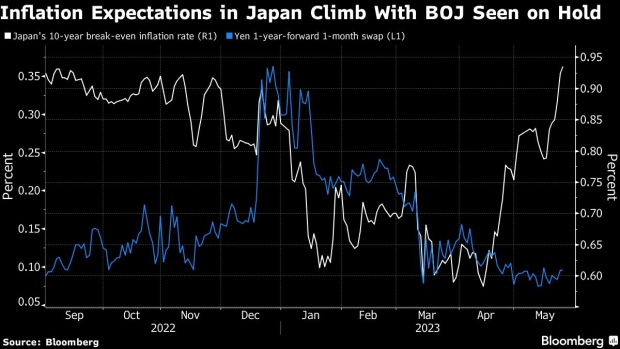

(Bloomberg) -- Demand for inflation protection hit fresh highs for the year in Japan as traders bet easy monetary policy will remain in place despite the relentless rise in consumer prices.

The 10-year break-even rate, a gauge of price expectations derived from inflation-linked government notes, climbed to 0.94% this week, the highest since late December. The sale of 10-year inflation-linked notes met strong investor demand on Tuesday, implying a rate of 1%, according to data compiled by Bloomberg.

“Investors are gradually coming to the view that the current inflationary pressure may not be temporary but may be sustained,” said Akio Kato, general manager of strategic research and investment at Mitsubishi UFJ Kokusai Asset Management Co. “The market expects the Bank of Japan to avoid altering ultra-easy monetary policy although it will probably raise inflation forecasts.”

The central bank is at a crossroads in its decades-long quest to end deflation. While soaring inflation has been fanning calls from economists for an adjustment to the BOJ’s ultra-accommodative monetary policy, Governor Kazuo Ueda has repeatedly emphasized the risk of a premature reduction in stimulus.

The BOJ has been raising its 2023 price projections but it’s still about 1% point lower than the consensus estimate of economists.

“Foreign investors are growing more confident that Japan’s inflation will not only surprise to the upside but also prove to be sticky,” said Naka Matsuzawa, chief strategist at Nomura Securities Co. in Tokyo. “It’s inevitable that the BOJ will raise its price forecasts in July. I expect the central bank to tweak its yield-curve control policy that time.”

--With assistance from Yumi Teso.

©2023 Bloomberg L.P.