Feb 27, 2020

Turkey Stages Turnaround That Could Rival World’s Economic Elite

, Bloomberg News

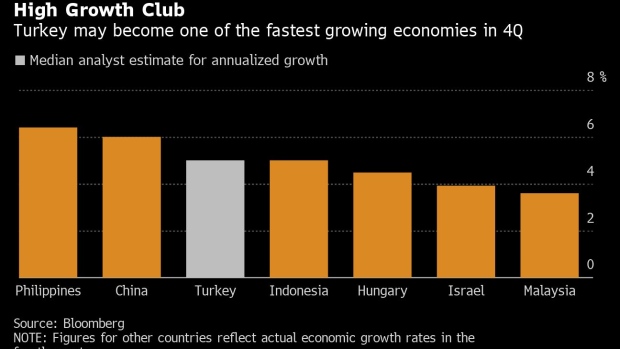

(Bloomberg) -- Turkey probably capped its comeback after a recession with a brief spurt worthy of Asia’s fastest growing economies.

A mix of stimulus policies that combined interest-rate cuts and a spending splurge last year offered a quick cure for an economy scarred by a currency crash in 2018. Seasonally and working day-adjusted data due Friday will show growth in gross domestic product more than tripled in the fourth quarter from the previous three months and reached 1.5%, according to the median forecast in a Bloomberg survey.

The year-on-year rate clocked in at 5%, up from just under 1% in the third quarter, another poll of analysts showed. The annual acceleration probably overtook the pace of expansion in Indonesia and fell just short of growth in China and the Philippines.

“Authorities are prioritizing growth, which they should be able to achieve in the near term given the large range of fiscal, quasi-fiscal and monetary policy instruments available to them,” Goldman Sachs Group Inc. economists including Kevin Daly said in a note before the data release. “We think that this will come at a cost.”

Although Turkey succeeded in quickly moving past its first technical recession in a decade, it risks sacrificing economic stability down the road. As gains in consumer spending and bank lending power the rebound, the current account swung back into deficit in the past two months of 2019 and inflation is on the rise.

The lira slipped to a fresh nine-month low on Thursday and is this month’s worst-performer in emerging markets after the Brazilian real and Russia’s ruble.

Authorities are relying on cheap credit to give the economy a shot in the arm. A new central banker installed by President Recep Tayyip Erdogan in July slashed Turkey’s benchmark rate by 1,200 basis points by end-2019, a campaign that’s stretched into this year. The government has set a target of 5% for economic growth in 2020-2022.

The challenge now is how to sustain enough momentum in the face of global threats such as the coronavirus outbreak, whose fallout is wreaking havoc on mobility and supply chains.

Erdogan’s deepening entanglement in the conflicts in Syria and Libya presents another risk, as Turkey draws closer to a confrontation with Russia. On the domestic front, youth unemployment is hovering near record highs and political tensions are keeping the market on edge.

Still, the rapid-fire rate cuts have pushed down the cost of loans and deposits, and succeeded in boosting confidence. Industrial production rose on an annual basis for a fourth month in December after a decline uninterrupted for a year following the currency crisis in August 2018.

“Inevitably, as in the past, short-term gain leads to long-term pain in Turkey,” said Nigel Rendell, a senior analyst at Medley Global Advisors LLC in London. “The key issue now is whether this is a sustainable recovery or one that is engineered to show some impressive short-term growth figures.”

--With assistance from Harumi Ichikura.

To contact the reporter on this story: Cagan Koc in Istanbul at ckoc2@bloomberg.net

To contact the editors responsible for this story: Onur Ant at oant@bloomberg.net, Paul Abelsky, Michael Gunn

©2020 Bloomberg L.P.