Mar 10, 2021

U.K. Investors Crave Inflation Protection But It’s Hard to Find

, Bloomberg News

(Bloomberg) -- U.K. investors were left scrambling to get a hold of government bonds that provide protection against a pickup in inflation, a sign of both the scarcity of such assets and concerns about the impact rising prices might have on portfolios.

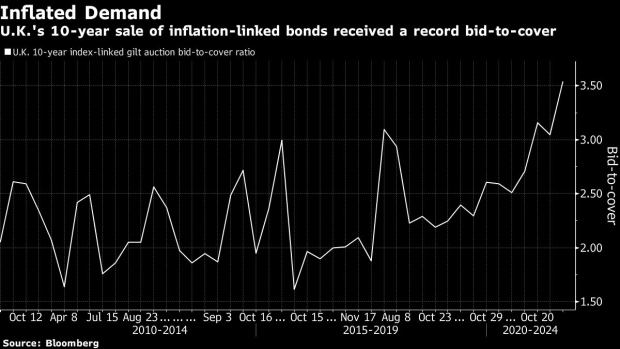

On Wednesday, the Debt Management Office received more than 3.5 times as many bids for the 800 million pounds ($1.1 billion) of 10-year inflation-linked gilts on offer. That’s the strongest demand on record for such a maturity, according to data compiled by Bloomberg. And it comes after the institution’s announcement last week that so-called linkers will comprise 11% of the supply for next fiscal year’s issuance, less than what banks had anticipated beforehand.

Inflation-linked bonds are popular among Britain’s pension and insurance funds, which use them as a way to hedge their future liabilities. They were already dealing with a dearth of supply from last year, when the DMO held back issuance during a consultation on the controversial Retail Price Index measure of price increases. Now, with traders betting on a faster pace of inflation in the U.K. and globally, that shortage has become even more pronounced.

“Inflation expectations and hedging needs have evidently increased,” said Adam Dent, U.K. rates strategist at Banco Santander SA. “And for the time being the supply just hasn’t kept up.”

U.K. 10-year breakevens, a gauge of price rises of the next decade, rose one basis point to 3.42%, close to its highest level since 2019.

Globally, conventional government bonds have tumbled this year as the rollout of vaccines spurs hopes of a sharp recovery from the coronavirus-induced recession.

The U.K. is coming off the back of its worst contraction in three centuries, but its rapid pace of inoculations and plan to fully reopen the economy by the summer is fueling bets of more inflationary pressure. That said, the Bank of England noted repeatedly that negative interest rates are still on the table.

Though inflation-linked debt is in short supply in the U.K., they make up about 18% of the DMO’s total bond pool, a higher share than most developed nations. The country is planning to sell its first green bond this summer, followed by a second one before the end of the year. It aims to sell at least 15 billion pounds in 2021-22.

©2021 Bloomberg L.P.