Nov 10, 2021

U.S. stocks extend slide; bonds fall on auction

, Bloomberg News

Spike in U.S. used car prices fuels higher inflation, once issues resolve inflation will decrease: Strategist

U.S. stocks fell by the most in a month and Treasury yields spiked higher as a hot inflation reading roiled financial markets.

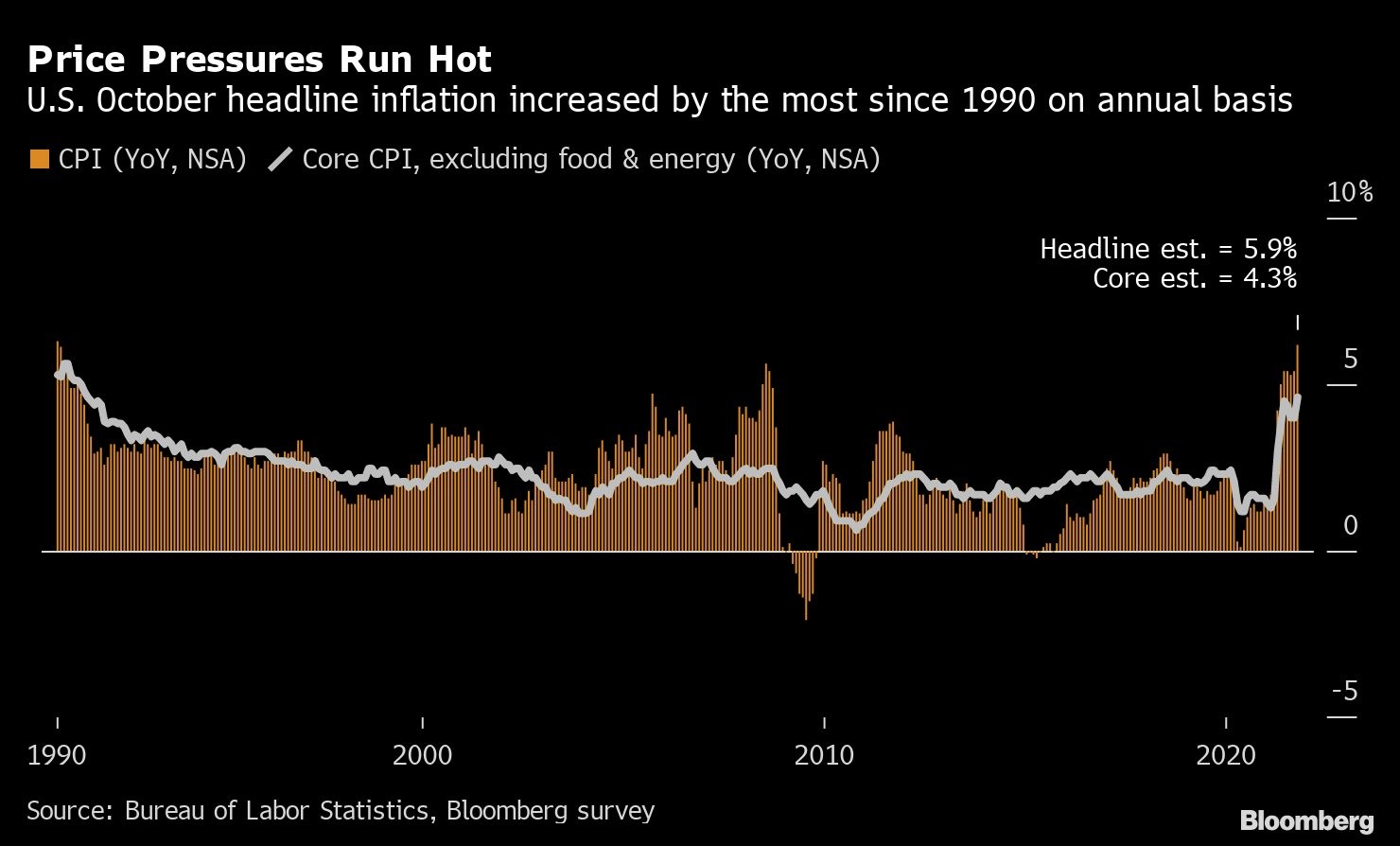

The S&P 500 slid 0.8 per cent, extending earlier losses, after a 30-year Treasury auction went off at higher yields than anticipated. Two-year yields also shot higher after data showed the fastest annual inflation rate since 1990, upending bets on the timing for the next interest rate increase.

The Nasdaq 100 led declines in equities as its highly valued tech members are deemed most susceptible to the impact from inflation. The dollar hit a 52-week high, oil slumped more than 3 per cent and gold gained.

Risks are building for both stocks and bonds as persistent elevated inflation could force the Federal Reserve to taper at a more substantial rate or hike interest rates faster than anticipated. The U.S. consumer price index increased 6.2 per cent in October from a year earlier, beating expectations for 5.9 per cent, according to Bloomberg data.

“Now that it’s breached that 6 per cent level, I think the Fed are going to be getting a little bit hot under the collar,” Fiona Cincotta, senior financial markets analyst at City Index, said by phone. “There is no way, I think, they can ignore 6.2 per cent on that CPI reading. It’s going to be prompting a more hawkish feel.”

Treasury Secretary Janet Yellen on Tuesday reiterated her view that elevated U.S. inflation won’t persist beyond next year and said the Fed will not allow a repeat of 1970s-style price rises. Still, traders worry the latest figures may be enough to compel the Fed to raise rates as soon as June 2022 when it has finished tapering its assets-purchase program.

“I expect lots of eyeballs were bulging out of their sockets when they saw the number come in,” said Seema Shah, chief strategist at Principal Global Investors. “Inflation is clearly getting worse before it gets better, while the significant rise in shelter prices is adding to concerning evidence of a broadening in inflation pressures.”

The U.S. five-year breakeven rate on Treasury inflation protected securities rose to a record. Meanwhile, the yield on the U.S. 10-year note gained 13 basis points to 1.56 per cent.

“I can’t explain why the bond market is so content with the current situation, but inflation has been running hot for about a year and the bond market has not panicked,” Michael Zigmont, head of trading and research at Harvest Volatility Management, said by phone. “The bond market seems very, very happy with negative real yields. And as long as the bond market is happy, the Fed can be very slow.”

Bitcoin erased gains after hitting a record. Iron ore tumbled on dimming prospects for steel demand owing to China’s real-estate troubles. And in Europe, equities gained while those in Asia fell.

Stocks

- The S&P 500 fell 0.8 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 1.4 per cent

- The Dow Jones Industrial Average fell 0.7 per cent

- The MSCI World index fell 0.8 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.9 per cent

- The euro fell 1 per cent to US$1.1478

- The British pound fell 1.1 per cent to US$1.3408

- The Japanese yen fell 0.9 per cent to 113.90 per dollar

Bonds

- The yield on 10-year Treasuries advanced 13 basis points to 1.56 per cent

- Germany’s 10-year yield advanced five basis points to -0.25 per cent

- Britain’s 10-year yield advanced 10 basis points to 0.92 per cent

Commodities

- West Texas Intermediate crude fell 3.4 per cent to US$81.33 a barrel

- Gold futures rose 1.3 per cent to US$1,854.60 an ounce