Mar 23, 2022

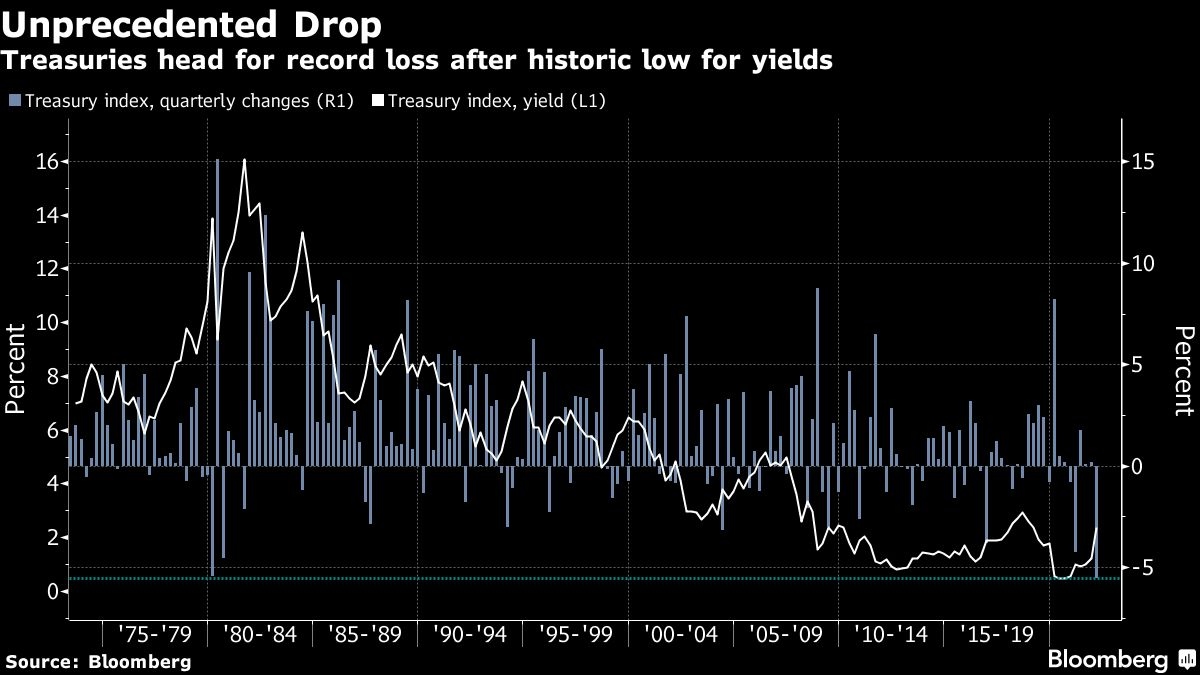

U.S. stocks halt rally as bonds stem record losses

, Bloomberg News

A lot of big-name tech stocks are going 'stupid cheap': Investment advisor Allan Small

U.S. stocks declined Wednesday as Treasuries staged a small recovery from unprecedented losses ahead of tighter monetary policy to curb inflation.

The S&P 500 fell 1.2 per cent, led by losses in financials, while the benchmark 10-year Treasury yield slid to 2.30 per cent after surging to highs unseen since mid-2019.

Bonds are taking the brunt of central-bank calls for tougher action to reign in inflation as investors hold up stocks as an inflation hedge, spurring a rally that had seen the S&P 500 recover half its decline from January over just six sessions.

“Certainly it’s been a tough start to the year and you just are going to have these natural ebbs and flows as people digest information,” said Lisa Erickson, senior vice president and head of traditional investment at U.S. Bank Wealth Management. “Overall we are expecting this kind of volatility that we have seen to continue.”

Investors have fled from bonds as Federal Reserve officials have indicated they’re willing to hike rates aggressively to tame inflation and the war on Ukraine drives commodity prices up 26 per cent this year.

Oil pushed higher Wednesday on the risk of fresh curbs on Russia, one of the biggest crude producers. West Texas Intermediate topped US$110 a barrel while Brent futures rose above US$120 a barrel. President Joe Biden and allies meeting Thursday in Brussels are expected to announce new sanctions against Russia.

Derivatives traders are braced for a steeper rate cycle after Fed Chair Jerome Powell explicitly put a half-point hike on the table in May if needed. His view is that the economy is strong enough to weather higher borrowing costs, a sentiment echoed by Fed hawks and doves alike.

Asked if quality names could outperform inflation, Wells Fargo Securities strategist Anna Han said in a Bloomberg TV interview she sees opportunities in value stocks.

“If the Fed really continues with the more aggressive rate hike schedule, I think they still have a chance, but at the same time it really depends on if the Fed can maintain that aggressive schedule that they do and really bring down inflation and grab inflation and face it head on.”

Nevertheless, growth concerns are unsettling markets as war rages in Ukraine and consumers shoulder the rising cost of living.

“We live in a world of macro uncertainty, increased volatility. And the Fed, like us, are going to have to watch the data,” Kristof Gleich, president and CIO of Harbor Capital Advisors, said. “That’s going to cause even more volatility to the markets, because the markets don’t like uncertainty.”

Gold climbed, the dollar was steady and Bitcoin was little changed.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.2 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 1.4 per cent

- The Dow Jones Industrial Average fell 1.3 per cent

- The MSCI World index fell 0.7 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.1 per cent

- The euro fell 0.2 per cent to US$1.1005

- The British pound fell 0.4 per cent to US$1.3208

- The Japanese yen fell 0.3 per cent to 121.12 per dollar

Bonds

- The yield on 10-year Treasuries declined nine basis points to 2.30 per cent

- Germany’s 10-year yield declined four basis points to 0.47 per cent

- Britain’s 10-year yield declined eight basis points to 1.63 per cent

Commodities

- West Texas Intermediate crude rose 4.7 per cent to US$114.44 a barrel

- Gold futures rose 1.3 per cent to US$1,952.20 an ounce