Apr 21, 2022

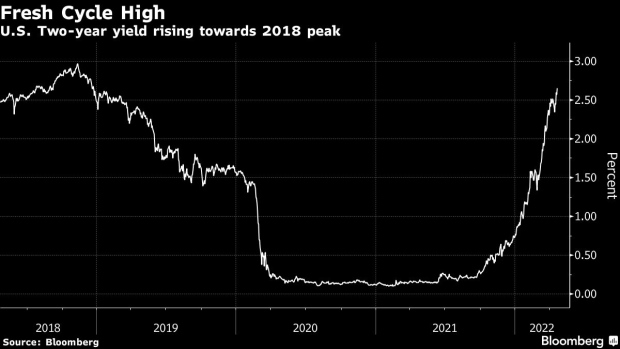

U.S. Two-Year Yield at New Cycle High in Fed-Driven Selloff

, Bloomberg News

(Bloomberg) -- Treasury yields resumed their climb Thursday led by the two-year note as traders began to hedge the possibility that the Federal Reserve will tighten policy more sharply at forthcoming meetings.

The policy-sensitive two-year yield climbed almost 10 basis points to a fresh cycle peak above 2.67% as traders began pricing in the first hint of a 75 basis-point rate hike at either the May or June policy meetings. Selling pressure extended across the Treasury curve with the five-year yield up 8.5 basis points at 2.945%. The 10-year rose 6.5 basis points to 2.895% and the 30-year bond was 6 basis points higher at 2.93%.

The renewed bearish tone in the bond market was spurred in part by a selloff in Eurozone government debt on heightened expectations for rate hikes later this summer in the region. The German two-year yield surged 12 basis points to 0.16%, its highest level since 2014 and up from minus 0.7% in March. The U.K. two-year gilt yield climbed nearly 15 basis points to 1.70%, its highest level since 2009.

Traders are also waiting to hear Fed chair Jay Powell, who is speaking alongside ECB President Christine Lagarde at an IMF panel at 1pm. Powell’s remarks will mark the final public appearance by a Fed official before the May 4 meeting and are expected to solidify expectations of a half-point rise in the funds rate from its current range of 0.25% to 0.5%. Traders are also attuned to any details regarding plans by the central bank to shrink its $9 trillion balance sheet.

In addition, Powell will deliver welcome remarks before the Volcker Alliance and Penn Institute for Urban Research’s Special Briefing entitled, “Inflation and Recession Risks for States and Cities” at 11 a.m.

All told, the U.S. rates market now expects 2.33 percentage points of additional rate hikes by the Fed’s December meeting, a rise of 20 basis points since the close on Monday. Selling pressure in the front end was triggered in part by large block sales in both the two-year note and September 2022 eurodollar futures contracts. Fed-dated OIS contracts priced in 103 basis points of rate hikes over the next two policy meetings, or an additional 3 basis points more than two 50 basis point moves.

©2022 Bloomberg L.P.