Mar 19, 2024

Ueda’s Fast Move Triggers Split on Whether BOJ Is Done Hiking

, Bloomberg News

(Bloomberg) -- Now that Japan increased interest rates for the first time since 2007, investors and economists are divided over how long it will take before the central bank opts for another hike.

Bank of Japan watchers agree that it won’t aggressively raise rates at the pace the Federal Reserve moved when it was battling inflation. But the consensus on how far the BOJ will go largely breaks down after that — and Governor Kazuo Ueda provided enough ammunition for both sides of the argument in a carefully hedged press briefing on Tuesday after ending Japan’s eight-year experiment with negative rates.

Currency traders focused primarily on Ueda and the BOJ’s insistence that easy financial conditions will stay in place for now. That stance helped weaken the yen by more than 1% beyond the 150 mark against the dollar, as some market participants concluded the BOJ will sit on its new 0% to 0.1% rate for the rest of the year, particularly as the economy looks weak.

Analysts surveyed by Bloomberg are forecasting the BOJ’s policy target rate at 0.1% at the end of this year, indicating a majority doesn’t expect another rate hike as a base case. But plenty of others are warning that the BOJ may not be finished.

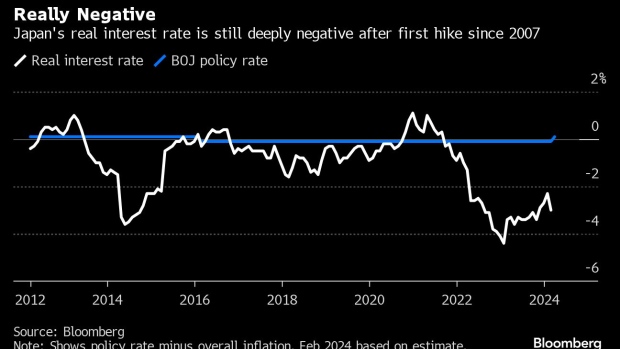

By moving in March instead of the long-held consensus view of April, Ueda secured more space to raise borrowing costs again in 2024 if data supports the case. The governor repeatedly said Tuesday that real interest rates in Japan remain deeply negative, and renewed weakness in the yen may also spark concern among government officials seeking more action to firm up the currency.

Looking at Japan’s real interest rates suggests there is plenty of scope for moving upward while keeping conditions easy. Economists estimate that inflation in February was 2.9%, a level that would put the latest real rate at -2.8%. The BOJ’s price target is 2%, a goal Ueda said Tuesday has “come within view.”

While economists polled by Bloomberg have cited 0.5% as the likely terminal rate of the BOJ’s hiking cycle, the spread of opinions is very wide: Sony Financial Group’s Masaaki Kanno is eyeing 2%, for instance, while Itochu Research Institute’s Atsushi Takeda has penciled in 2.5%.

Ueda acknowledged Tuesday that it wasn’t easy to determine the ideal interest rate for the economy. He flagged the difficulty of calculating both the neutral rate and agreeing on all the inputs for the Taylor Rule, a formula for central banks to set rates at an optimal level to stabilize economic activity. Ueda has cited the rule on occasion in the past to explain his views on interest rates.

“Given all the numbers you plug in and the different parameters and the way you apply them, you end up with a large variety of interest rate levels,” Ueda said, indicating he was against any mechanical application of a rule that produced a range of results.

Those predicting a hike point to Rengo, a federation of unions, which showed that its members have so far secured deals averaging 5.28%, the biggest in more than 30 years. Those numbers triggered a recalibration of views among economists toward a likely March move by the BOJ and the chance of inflation building momentum.

Read more: BOJ’s Ueda Would Need to Hike Rates If He Used Taylor Rule Again

BNP Paribas economist Ryutaro Kono flagged the risk of faster rate hikes if higher wages fuel upward movement in prices.

“In that case, rates would top 1% by the end of 2025,” Kono wrote in a note Tuesday. “Also, depending on the exchange rate and how personnel costs are passed on to prices after April, there’s a risk of the second rate hike being brought forward to July.”

The counterargument is that economic growth remains lackluster, inflation is decelerating and other major central banks are about to start cutting rates.

“This is a one and done,” said Tuuli McCully, senior economist at the Bank of Finland Institute for Emerging Economies. “They had to act now, because even a month from now they may have lost the opportunity to normalize things.”

While the talk of continuing easy conditions reinforced that view among some economists, others flagged the need to look at what Ueda has done rather than his dovish messaging.

When Ueda took over last April, his initial comments suggested he was far more aligned with previous Governor Haruhiko Kuroda’s thinking and would move much more slowly to tighten policy. Ultimately, though, his desire for a monetary framework with greater textbook orthodoxy seems to have prompted him to surprise BOJ watchers in moving quickly to dismantle the biggest monetary stimulus experiment in post-World War II history.

‘Nerves of Steel’

Investors may need to be prepared for a similar pattern playing out. Ueda emphasized Tuesday the need to keep conditions easy for the economy for now while also flagging that an increase in the upward risks to prices would warrant another rate hike.

Hideo Kumano, economist at Dai-Ichi Life Research Institute, expects another hike due to inflationary pressures like wage hikes at smaller companies, a rise in oil prices and the end of government price relief measures. He also pointed to Ueda’s resolve in following through with the BOJ’s hike ahead of the April consensus timing after checking wage data released as recently as Friday.

“He made such a big decision within just a few days of the strong spring wage results,” said Kumano, who expects the next hike to come in October or December. “You can’t do something like that unless you have nerves of steel.”

(Updates with details throughout)

©2024 Bloomberg L.P.