Oct 18, 2022

UK Braces for Sudden Return of Austerity as Hunt Demands Savings

, Bloomberg News

(Bloomberg) -- Liz Truss’s UK government has raced from massive tax cuts and stimulus to what is effectively austerity 2.0 in a matter of days.

All government departments are being told to find savings, which outside of health and defense are expected to be as much as 15% of budgets, people familiar with the matter said. No options are off the table and new Chancellor of the Exchequer Jeremy Hunt has even refused to guarantee he will stick to a key Conservative Party manifesto pledge to raise the state pension in line with the highest of inflation, wages or 2.5% -- known as the “triple lock.”

The implications are seismic. It’s a gift to the opposition Labour Party, who are already drawing comparisons with the hollowing out of public services under the Tory-led coalition government between 2010 and 2015.

But whereas David Cameron and George Osborne frequently blamed Labour and the financial crisis, the political dynamics are very different this time. The Tories trail Labour by unprecedented margins in polls because the sudden unraveling of public finances happened on the ruling party’s watch.

Hunt has denied his plans represent austerity and said cuts won’t reach the levels of the 2010s -- yet he also warned he faces “decisions of eye-watering difficulty” on tax and spending. Below is a snapshot of the state of play.

The Problem

On Monday, Hunt scrapped £32 billion ($36.2 billion) of Truss’s tax giveaway and said more “difficult decisions” are inevitable before a fiscal statement on Oct. 31. The Bank of England starts its delayed bond sales the following day.

Before the U-Turns, the Institute for Fiscal Studies estimated the government had to fill a £60 billion hole to stabilize debt as a share of gross domestic product. Others suggested the shortfall could have been even larger. Hunt’s tax changes, combined with lower borrowing costs due to improved market sentiment, leaves an estimated £15 billion to £25 billion for Hunt to find if he’s to meet the government’s talk of having debt falling within three years.

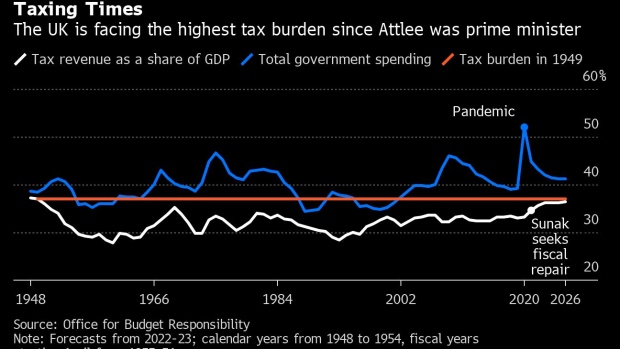

Raising Taxes

Truss won the Tory leadership campaign by making low-tax, small-state promises, so Hunt’s warning that some taxes would rise is a major political embarrassment for the prime minister.

Senior bankers fear an extension of the bank levy, a tax on the windfall gains from the combination of higher interest rates and the large stock of money created through quantitative easing. That might raise as much as £5 billion.

Former Conservative chancellors have looked at tax relief on pensions contributions. Removing the top rate of relief and raising the lower rate to make the arrangement fairer could also raise about £5 billion.

The government has already said the windfall tax on North Sea energy producers will be extended to the renewables and nuclear sector. Estimates of the potential revenue range from £5 billion to £10 billion.

Department Savings

The government set out department spending limits in 2021, and while it is expected to stick to those cash targets, that means a real-terms reduction because of the surge in inflation this year. According to the IFS, £5 billion of savings is needed just to pay for higher wages.

Departments have been asked to find more, and Hunt has hinted at sharp real-terms cuts. One likely target is the international aid budget. Another area could be investment projects such as rail, where cutting annual plans back to 2% of GDP in line with past averages would save £14 billion, the IFS said.

That could also mean scrapping plans for new hospitals and school renovations, and would likely trigger a backlash among Conservative MPs because “leveling up’ disadvantaged areas of the UK was another key manifesto pledge.

Hunt told Parliament on Monday that lowering public investment would damage growth prospects, but capital spending cuts are almost certain, according to Torsten Bell, chief executive of the Resolution Foundation.

Benefits and Pensions

Truss has already faced a major row in the party after she refused to commit to raising welfare payments in line with surging inflation -- something she signaled she would do for recipients of the state pension.

In his Parliament statement, Hunt said several times his priority in finding cuts would be to ensure the “vulnerable” are protected, but stopped short of any commitment on welfare payments. But he also refused to commit to the triple lock on pensions. That’s a major political gamble because it would anger older voters, who statistically are significantly more likely to vote Tory.

Truss’s spokesman also said no decision had been taken on the triple lock, which would see pensions uprated by about 10% in line with inflation next year.

Raising all benefits including pensions in line with earnings rather than inflation would save about £13 billion a year. If pensions are protected and working age benefits are not, the saving is £7 billion.

Cameron’s coalition government, also capped housing benefit payments, forcing people to move to cheaper areas. The idea has resurfaced again.

Energy Support

Hunt is ditching the government’s two-year energy-price freeze in April because he said the measure -- which could have cost over £200 billion -- exposes public finances to “unlimited volatility” in international gas prices, and that he wanted a more targeted measure instead.

But the change potentially exposes an average household to bills of £4,500 a year, nearly double the £2,500 average under the current plan.

One proposal recommended last week by the International Monetary Fund was a mixed tariff arrangement. Every household would receive a subsidy for a certain amount of energy use, beyond which the market price applies. The idea would be to set the subsidized rate at a level of energy consumption to cover almost the entire bill for poor and lower-middle income households.

An alternative proposal backed by the UK energy industry is a “social tariff” available only to people below a certain level of income. The protected group could be households which are on some form of benefit. The discount is covered by the government. Such a system already operates in Belgium.

©2022 Bloomberg L.P.