Nov 17, 2022

UK Recession Wipes Out Eight Years of Family Income Growth

, Bloomberg News

(Bloomberg) -- Britain’s cost of living crisis will wipe out eight years of growth in household incomes in just 24 months and plunge the economy into a recession lasting more than a year, the government’s independent forecaster said.

The Office for Budget Responsibility said real household incomes will shrink by 7% over the two years to April 2024 despite £100 billion of government support. The economy is already in a recession that will see output contract by 2% and cost 500,000 jobs, it said.

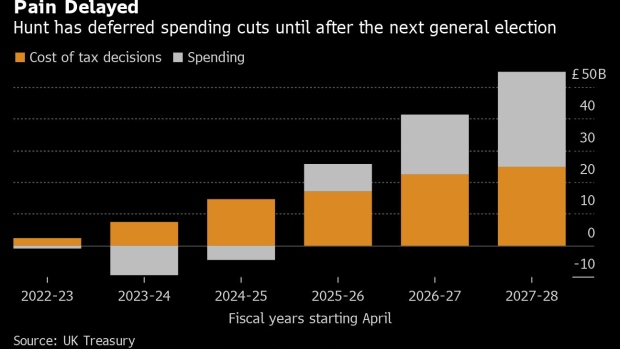

The bleak forecasts were released alongside the Chancellor of the Exchequer Jeremy Hunt’s autumn statement. He pledged to both support households over the recession and the depths of the energy crisis and bring debt under control by 2027-28.

In a program he said was designed to prioritize “stability, growth and public services,” Hunt raised the tax burden to its highest level since World War II, at 37.1% of GDP -- far above the levels that created political problems in March for Prime Minister Rishi Sunak when he was chancellor.

Hunt’s plan was in part a response to the chaotic 44 days of Liz Truss’s premiership, when her £45 billion of unfunded tax cuts sparked panic among investors that sent the pound plunging to record lows. To demonstrate his commitment to sustainable public finances, Hunt announced a £55 billion consolidation to ensure debt is falling as a share of GDP by 2027-28.

That meant a £100 billion swing in policy settings in just 55 days by the same Conservative party.

The combination of the recession, higher inflation and rising interest rates led to a £75 billion increase in borrowing compared with March expectations in the key 2027-28 forecast year. The OBR said “almost two thirds was due to higher debt interest costs.”

Permanently higher interest rates, alongside higher welfare spending and a smaller economy than expected, will mean the UK ends up with a permanently larger state. As a result, taxes need to rise to prevent the national debt spiraling upwards.

To fill the hole, Hunt announced £61.7 billion of savings through a combination of tax rises and spending cuts in 2027-28. The national debt rises from 84.3% of GDP last year to 97.6% in 2026-27, a 63- year high, before declining slightly.

The deterioration in the debt reflects weaker growth and support the government is providing for households in the crisis, which takes borrowing to a record £170 billion this year -- excluding the first year of the pandemic -- and £140 billion next year.

The recession and falling energy prices will drag inflation below zero in 2025 before rising back to the 2% target.

Read more:

- Hunt Hits Wealthy With Higher Taxes in £55 Billion Squeeze on UK

--With assistance from Andrew Atkinson.

©2022 Bloomberg L.P.