Oct 1, 2022

UK’s Bruised Markets Need More Than BOE Support to Snap Back

, Bloomberg News

(Bloomberg) --

Having settled into an uneasy calm after the Bank of England action staunched a record government bond selloff, UK markets risk a return of the turmoil.

The bank’s intervention averted what some say could have been a financial catastrophe, triggered by a gilt selling avalanche from pension funds. It helped long-dated bonds reverse course and post their biggest-ever rally, while the pound bounced off record lows to trade above $1.12 on Friday, its biggest weekly gain since 2020.

But if a slump to parity versus the dollar has been dodged, it may not be for long -- unless Prime Minister Liz Truss executes a U-turn on her plan for some 45 billion pounds worth of unfunded tax cuts.

Truss has so far signalled she will stick to her guns. Investors’ hopes have also been dashed that full forecasts might be published by the Office for Budget Responsibility, an independent watchdog, earlier than the scheduled Nov. 23 date. They will look for any signs of a softer stance from the government.

“Market reaction shows that confidence was damaged substantially,” Julius Baer economist David Alexander Meier said.

“The government would be advised to take markets more seriously and bring forward the detailed budget with its projections on the fiscal balance, or at least offer more detail on the impact of its plans on the UK’s balance,” Meier said. “That could restore confidence.”

The Bank of England’s revived asset purchase program is to last only two weeks however, and the bank will almost certainly deliver a string of hefty interest rate rises in coming months,. In short, Truss’s ambitions to kickstart growth are squarely at odds with central bank policy.

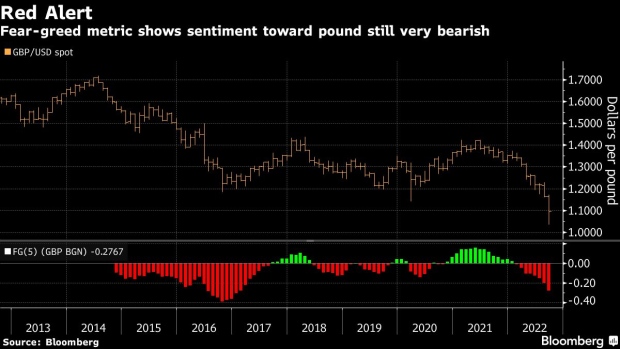

Meanwhile on the pound, the fear-greed indicator, a technical measure used by traders to gauge the strength of buying or selling intentions, is at the most bearish level since the UK voted in 2016 to leave the European Union.

Chris Turner, a strategist at ING Bank NV said the government still needed to find a way to “balance the books.”

But Turner noted that with Truss’s Conservative party gathering this weekend for a conference, it’s “far too early for a U-turn on fiscal policy and, combined with a very difficult external environment, sterling should stay vulnerable.”

Truss Won’t Change Fiscal Plan After UK Budget Watchdog Meeting

Investors will also be on alert in coming days for any negative action from the ratings agencies, particularly after Moody’s Investors Service warned of lasting damage to the nation’s debt affordability.

Here’s a snapshot of what’s happening across other UK markets:

Gilts

UK 30-year yields had dropped to nearly 3.80% by Friday after soaring past 5% earlier in the week, the highest since 1998. Still, the BOE is only planning to buy gilts until Oct. 14, and its plans to reduce its gilt portfolio are only on hold until the end of next month.

Credit risk

A measure of the UK’s credit risk has rocketed, soaring to levels last seen around the Brexit referendum in 2016 and the pandemic fueled-rout in 2020. While the implied probability of a default remains minuscule, it has become costlier for investors wanting to insure exposure to UK sovereign debt.

Stocks

The recent turmoil drove a 5% decline in the FTSE 250 index -- which is more dependent on the Britain’s economy than the FTSE 100-- and at one point pushing it to the lowest since May 2020.

But the latest falls only add to year-to-date losses which have sharply reduced the combined market capitalization of companies with a primary UK listing -- This is just over $133 billion above the nearest challenger Paris, a record low.

©2022 Bloomberg L.P.