Aug 18, 2022

UK’s Cost of Living Crisis Is Hitting Debt of Its Supermarkets

, Bloomberg News

(Bloomberg) -- British supermarkets are taking a hit in the credit markets after inflation accelerated to the highest in 40 years.

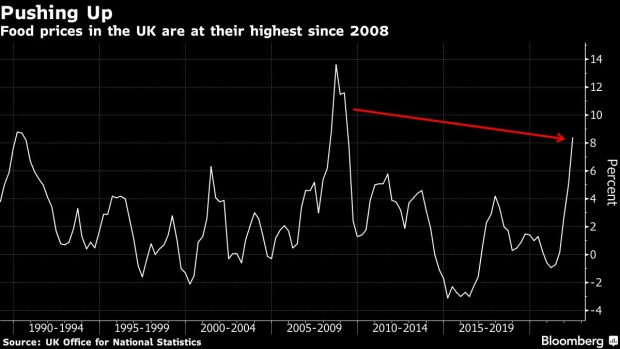

Bonds issued by Asda, Iceland Foods, Tesco Plc and groceries delivery firm Ocado Group Plc fell after data on Wednesday showed the UK Consumer Prices Index jumped 10.1% in July from a year earlier. Supermarkets’ bonds underperformed an index of sterling corporate bonds as rising food prices made the biggest contribution to the month’s increase.

UK inflation is running hotter than that of Western European counterparts, with sterling weakness, Brexit-related supply chain issues and soaring energy prices all contributing. Supermarkets are among sectors seeing the biggest impact, as price rises for essentials like dairy, meat and vegetables are difficult to pass on to already-squeezed consumers.

“Retailers generally are in a low margin business where you’re going to have a hard time passing on costs quickly,” said Kyle Kloc, a portfolio manager at Fisch Asset Management. Deteriorating relations with Brussels may exacerbate the issue if UK import duties go up, he said.

Yields on Asda’s most liquid bond, maturing in February 2026, rose as much as 31 basis points, to 9.2%, since Wednesday’s inflation data, while borrowing costs for Iceland Foods and Tesco also jumped. Yields for supermarkets’ bonds have pulled back slightly from July’s all-time highs, but have doubled in the last nine months while the UK’s economic situation has deteriorated.

The squeeze on consumers -- and supermarkets’ bonds -- comes at a time when some British grocers are already loaded up with debt following private equity takeovers.

Clayton, Dubilier & Rice’s 6.6 billion-pound ($7.95 billion) leveraged buyout of Wm Morrison Supermarkets Plc last year was the largest of a British company in more than a decade, with banks still trying to offload part of the debt in souring market conditions. And the acquisition of discount grocer Asda by Zuber and Mohsin Issa and TDR Capital, also last year, loaded up the grocer with over 3 billion pounds of debt.

The additional debt meant that both supermarket chains were subsequently downgraded by credit ratings agencies into junk territory, pushing up their borrowing costs even before the cost of living crisis gripped the UK.

“In this economic cycle, we’re going to see a lot more divergence between retail names,” said Gordon Shannon, portfolio manager at TwentyFour Asset Management. “Being in a weaker (debt) position, lower quality and worse rated will definitely be punished.”

Going into the winter, Britons face soaring bills to heat their homes on top of food-price rises. That means borrowing costs for supermarkets are unlikely to improve anytime soon.

For food costs, “the bad news is that there’s probably more to go,” said Deutsche Bank economist Sanjay Raja. After a “staggering” 11.6% increase in grocery prices over the past four weeks, according to Kantor, “our models point to a further surge over the coming months to around 12.5% year-on-year,” he said.

Raja doesn’t anticipate any meaningful drop in food prices until the second quarter of 2023.

Elsewhere in credit markets:

Europe

Financials are leading Thursday’s issuance activity, with Banco Santander SA, Lloyds Banking Group Plc and Credit Agricole SA among seven issuers raising at least 4.5 billion euros. That will push the week’s sales tally to at least 20 billion euros and the highest in eight weeks, according to data compiled by Bloomberg.

- It extends a bounce-back in issuance this week, with Wednesday the busiest day for sales since June 23

- It’s not just issuance that has picked up - Europe has also seen the busiest start to August for credit default swap trading since at least 2013, defying the traditional summer lull

- Almost 120 billion euros ($121.9 billion) of iTraxx Europe and Crossover index contracts changed hands in the first half of this month, based on Depository Trust and Clearing Corporation data compiled by Bloomberg

- Volumes in that two-week period were almost double the 10 year average

- While Europe’s corporate bond market is seeing a nascent deal revival following one of the slowest summers ever, some companies are opting to pay off their debts instead

- Green bond issuance is holding up better than plain vanilla debt this year, down just 3% compared with a 19% drop for standard bonds, according to Bloomberg data

- The resilience is notable considering that green bonds underperformed traditional issues in each of the first six months, a trend that only reversed in July

Asia

Asia’s dollar bond sale drought continued Thursday with no deals marketed, as debt insurance costs rose amid growing concerns about China’s economic outlook.

- Credit-default swaps in Asia ex-Japan were poised for a second day of widening on Thursday, according to traders, as investors became more risk averse

- Goldman Sachs Group Inc. economists downgraded their forecast for China’s full-year expansion to 3% from 3.3%

- Meanwhile in China, a supportive central bank and ample liquidity in domestic financial markets is helping local companies sell perpetual onshore bonds with the lowest-ever yields, according to Bloomberg-compiled data

- China’s largest property developers are now considered almost worthless by a mutual fund that holds the assets

- An exchange-traded fund run by HuaAn Fund Management Co. has assigned a value of HK$0.01 for each share of China Evergrande Group and Evergrande Property Services Group Ltd. in its portfolio

- Country Garden Group Holdings Ltd. is planning to sell an onshore bond with a state-owned entity’s guarantee, according to Chinese financial news service Cailian, as the government seeks to help some builders issue debt

- Asian banks, including Bank of China Ltd., are among a group of lenders that snapped up most of a £400 million loan financing the buyout of Unilever’s tea business at a steep discount

US

The US high-grade summer sales surge continued with nearly $8b sold on Tuesday, driving August volume to over $100b. This is the third time on record August has topped that mark as companies take advantage of lower borrowing costs compared to earlier this year and an investor base hungry for new paper.

- In 2020 and 2016, the last years when August reached the triple-digit mark, the following Septembers saw even greater new issue sales. This year may be different due to the Federal Reserve’s key monetary policy meeting in September, but we expect issuance to remain steady.

- The lone industrial deal of the day shined the most during syndication with Eaton Corp garnering a peak book of over $10bn for their $2bn bond sale

- The 30-year tranche finished with a final book size seven times covered, following the same seen during Monday’s session when Amgen’s 30-year tranche was 4.9 times oversubscribed

- Long-dated paper is seen as very attractive for investors as a good opportunity to pick up yield

- A rarely-used financial product that makes it easier to monitor the performance of sustainable projects has been endorsed as a reliable way to avoid greenwashing in the $4 trillion ESG debt market

- Brightline Holdings, the rail company backed by Fortress Investment Group, sold $770 million of unrated tax-free debt with hefty premiums for investors as it raises cash critical for the expansion of its underperforming Florida system

©2022 Bloomberg L.P.