Feb 27, 2023

UK Says BOE Losses on QT May Mean £200 Billion Hit for Taxpayers

, Bloomberg News

(Bloomberg) -- UK taxpayers will be on the hook for as much as £200 billion ($240 billion) of potential losses from the Bank of England’s quantitative easing program after the Treasury lodged plans to cover any future shortfall with parliament last week.

An update to the annual “supply estimates,” the government’s spending accounts, revealed that ministers have requested “an increase of £180 billion to provide budgetary cover for movements in the fair value of the Bank of England Asset Purchase Fund.”

A £20 billion fund has already been approved, and the additional request raises the total contingent liability to £200 billion. Of that, £11 billion was cleared last October by Parliament to be drawn down when needed. More than £5 billion has been transferred to the BOE already.

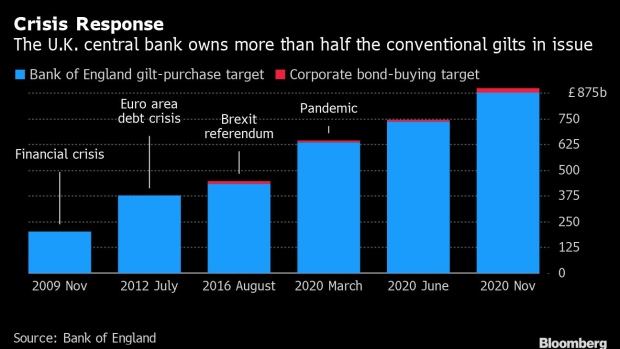

The figures reveal the scale of potential damage to the UK public finances from more than a decade of stimulus from the BOE under the quantitative easing program. The central bank bought government and corporate bonds to repress market interest rates and is now unwinding the purchases, triggering a loss on the money it had invested.

The transfers are politically tricky for Prime Minister Rishi Sunak’s government. Under the way QE operates, the taxpayer transfers are funneled through the BOE to high street lenders, boosting their profits. Taxpayer losses may also intensify criticism of QE, which is already blamed for causing wealth inequality.

The story was first reported by the Daily Telegraph.

A Treasury spokesperson said: “The actual amounts paid out depend on market conditions at the time, and this technical adjustment does not necessarily mean this will cost more than expected. This change has no impact on the government’s fiscal position.”

The public finances will only be affected as the liability is drawn down. Parliament will debate whether to approve the £200 billion liability on March 8.

The BOE bought £895 billion of government and corporate debt between 2009 and 2021 under QE after cutting interest rates close to zero. Under the legal arrangement of QE, the BOE swept all profits to the government but received a full indemnity on any losses. The reserve set aside is to make up for those losses as they’re realized little-by-little over the coming years at each step the BOE unwinds its purchases.

During the period of low rates, the BOE made around £120 billion of profits. It’s facing even larger losses now the rates have risen from 0.1% to 4%. The cost the taxpayer shows up in interest on the nation’s £2.4 trillion debt.

The Office for Budget Responsibility forecasts the Treasury to transfer £133 billion back to the BOE by 2028 “more than reversing the previous gains.”

The spending watchdog will update the figures in the March budget when it is expected to estimate the total net cost of QE, which will not fully run off the books until the 2040s. According to OBR figures, total losses are likely to be over £200 billion, costing the state almost £80 billion over the life of the scheme.

The BOE and the Treasury argue that QE was never designed to be a fiscal support scheme and has delivered more benefits on balance in better economic growth and reduced unemployment. The BOE and the Treasury also point out that the forward looking numbers are highly sensitive to changes in the outlook for market interest rates.

--With assistance from Andrew Atkinson.

(Updates with Treasury comment.)

©2023 Bloomberg L.P.