Feb 2, 2021

UPS rides e-commerce boom, price increases to higher profit

, Bloomberg News

David Burrows discusses FedEx and UPS

United Parcel Service Inc.’s profit jumped in the fourth quarter as a rush of online holiday shopping boosted package volume and enabled the courier to raise its prices.

The results marked a “turning point” for UPS’s efforts to increase revenue faster than volume, Chief Executive Officer Carol Tome told analysts Tuesday after the company reported earnings. While UPS declined to venture a detailed financial forecast because of uncertainty from the coronavirus pandemic, profit margins will expand in 2021, Tome said.

UPS is expecting another strong year after record sales in 2020, as consumers continue to avoid stores in favor of e-commerce shipments to their homes. That’s powering demand for the courier’s ground deliveries while the air-freight operation is poised for growth as it ramps up global distribution of COVID-19 vaccines.

“These results will go a long way to re-energizing investors about the potential for meaningful profit improvement at UPS over the next several years under the leadership of its new CEO,” Jack Atkins, an analyst with Stephens, said in a note to clients.

The shares rose 4.3 per cent to US$162.92 at 3:20 p.m. in New York. UPS surged 51 per cent in the 12 months through Monday, easily outpacing the 16 per cent gain of the S&P 500 Transportation Index.

Capacity Squeeze

UPS is benefiting from a capacity shortage in the parcel market of about 2 million packages a day this year, Tome said. The Atlanta-based company will boost sorting capacity by 130,000 packages an hour with the expansion of seven buildings this year and 11 new aircraft.

“We are planning to grow smartly,” Tome said.

The capacity shortfall has enabled UPS to focus on increasing business from small-business customers, which are usually more profitable for the courier because they don’t get big discounts like large shippers do. In the fourth quarter, volume from small and midsize companies rose more than 28 per cent while business from large customers climbed only 4 per cent.

UPS had one of its smoothest peak seasons last year despite soaring volume. The company flexed its pricing power by adding fees on large retailers while sometimes throttling back service for customers whose volume exceeded agreed-upon levels.

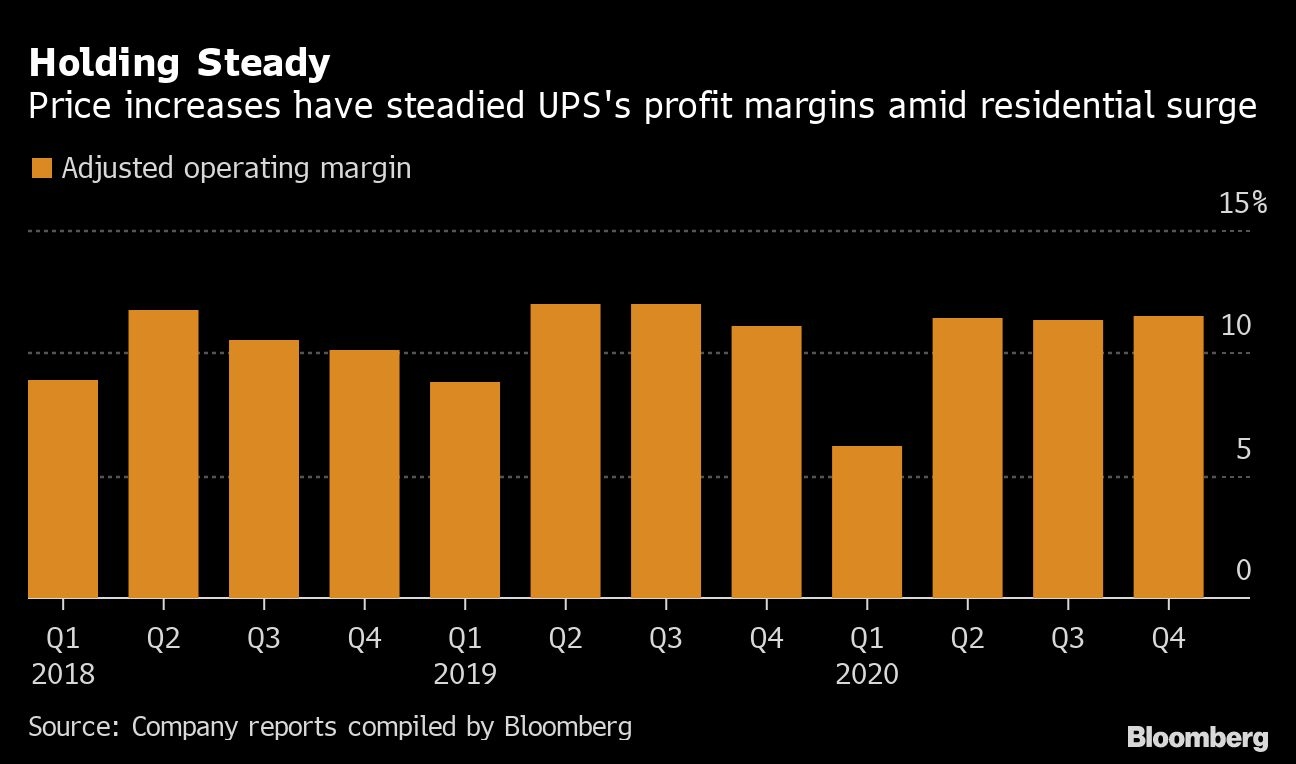

That helped UPS increase revenue per ground package by 7.8 per cent even as it handled more residential deliveries, which are typically less profitable than drop-offs at businesses. Commercial shipments fell 8.3 per cent in the quarter, and Tome said in an interview that she doesn’t expect business demand to improve much this year.

‘Launching Point’

While the domestic division’s adjusted profit margin softened slightly to 8.8 per cent, that was enough to beat Citigroup Inc.’s estimate of 7.2 per cent.

“Collectively, we believe these results are a strong launching point for profit growth in 2021,” Citigroup analyst Christian Wetherbee said.

The air-freight operation also increased prices and kept planes full amid last year’s dearth of commercial flights, which often carry cargo as well as passengers. That pushed the unit’s operating margin to more than 24 per cent, which helped lift UPS’s overall adjusted operating profit margin to 11.5 per cent -- the highest since the third quarter of 2019.

Adjusted earnings climbed to US$2.66 a share in the fourth quarter, topping the US$2.15 average of analyst estimates compiled by Bloomberg. Total sales jumped 21 per cent to US$24.9 billion in the fourth quarter, while analysts expected US$22.9 billion.

Revenue from Amazon rose to 13.3 per cent of UPS’s total sales last year, or about US$11.3 billion. That’s up from 11.6 per cent of sales in 2019, or US$8.6 billion.

Tome last week made her first big move to slim down UPS and focus on its core package business, reaching an agreement to sell the company’s freight unit. The business was capital intensive and had low profit margins, she said. Outside of the company’s core principles, “everything else is under review,” Tome told analysts.

“With the disposition of UPS Freight, we will be smaller, but we will be better,” she said. UPS is planning a June 9 meeting with investors to provide more detail about its plans to shore up margins.

Paring Investment

She extended that theme with the earnings release, saying UPS will cut capital expenditures to US$4 billion this year from an unadjusted US$5.4 billion in 2020. The company spent more than US$6 billion a year in 2018 and 2019 to increase automation and capacity.

The CEO, who took the reins in June, also said the company won’t buy back shares this year and instead will pay down US$2.5 billion of long-term debt when it comes due with a goal of strengthening the credit rating.

“We have ample room to allocate capital back into the business and back to the shareholders,” Tome said. “We just want to make sure that we generate the right return on that.”