Apr 8, 2023

US Consumer Prices Are Seen Staying Firm, Testing the Fed

, Bloomberg News

(Bloomberg) -- US inflation was largely unwavering in March, with economists projecting a monthly increase in consumer prices on par with advances seen over the previous half year that will test the Federal Reserve’s mettle.

Government figures Wednesday are expected to show a 0.4% monthly gain in the core consumer price index, which excludes food and energy and better reflects the scope of underlying inflation facing American households.

While softer than the 0.5% advance in the prior month, such an increase would match the September-February average and keeps year-on-year figures stubbornly high. That may help tip the scales toward another interest rate hike at the Fed’s May meeting, despite stress in the banking system and signs of a slowing economy.

Meanwhile, minutes of the Fed’s March 21-22 meeting, also released on Wednesday, may provide clues about the appetite for further policy tightening as well as views on the health of the banking system and lending.

The Fed’s speaking calendar is busy in the coming week and includes appearances by regional bank presidents John Williams, Patrick Harker, Austan Goolsbee, Neel Kashkari and Thomas Barkin.

US core CPI is seen rising 5.6% from a year ago, which would be an acceleration from February’s annual gain. Including food and fuel, the price gauge is forecast to climb by 5.1%, the smallest advance in nearly two years. The central bank’s goal, based on a different inflation metric, is 2%.

Since soaring to a four-decade high of 9.1%, the overall CPI has been retreating in step with falling energy prices. Those costs, however, may start to rise again after the OPEC+ announcement on April 2 of a surprise cut in crude production. Rising crude oil prices may bleed through to gasoline and jet fuel just as Americans begin their summer vacation planning.

Read more: Oil Price Jolt Compounds Inflation Puzzle for Central Banks

Among other US economic reports, the government will release March retail sales. Economists project sales fell for the fourth time in the past five months, with high inflation restraining goods purchases and consumers allocating more of their discretionary incomes to services.

What Bloomberg Economics Says:

“The March CPI report will offer glimmers of good news on disinflation. Plunging natural gas prices in California, aided by a state government credit, helped. But the goods news is likely transitory – oil prices are rising again after OPEC+ announced production cuts. If that results in persistently rising gasoline prices, it could offset any disinflation gains in the next few months.”

—Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church, economists. For full analysis, click here

Elsewhere, Washington will steal the limelight as finance ministers and central bankers flock there for spring meetings of the International Monetary Fund and World Bank. The IMF’s new economic forecast will be published on Tuesday, while a Group of 20 gathering of finance chiefs begins the next day.

Meanwhile, central banks in Canada, South Korea and Peru may all keep rates unchanged in the coming days.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Canada

Bank of Canada Governor Tiff Macklem will likely stick to the sidelines for a second time on Wednesday. He’s seen holding the benchmark overnight rate at a 15-year high of 4.5%, despite few signs the economy is gearing down.

Employment blew past expectations for a fourth-straight month in March, with wage gains again coming in beyond a level policymakers view as consistent with bringing inflation back to target. Economic growth in the first quarter is also tracking well beyond the bank’s projections.

Traders will look for any shift in language around a willingness to hike again if needed, given financial stability concerns that have potentially shifted the balance of risks. Swaps markets see the Bank of Canada’s next likely move as a cut later this year.

Macklem’s decision will be released alongside a new set of forecasts that will likely push back the timing of an expected stall, with inflation still falling to 2% some time next year. The governor will take questions from reporters afterward.

Asia

The Bank of Japan’s new Governor Kazuo Ueda starts his term, inheriting a decade of massive stimulus policy from Haruhiko Kuroda. He’s expected to head to the IMF Spring meetings with Finance Minister Shunichi Suzuki, participating in his first high-profile international conference as central bank chief.

On Tuesday, the Bank of Korea meets to deliver its latest policy decision. Amid concerns over the economic growth and inflation, the Korean central bank may hold its benchmark interest rate steady again, after it kept rates unchanged in February for the first time in over a year.

China’s inflation data on Tuesday will likely show subdued price pressures as growth slowly recovers, while trade figures on Thursday are expected to show exports still contracting amid a slump in global demand.

Australia’s jobs data will be closely watched on Thursday after central bank Governor Philip Lowe paused his year-long tightening campaign.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

In a week shortened throughout much of the region by the Easter holiday on Monday, the focus is likely to be on Washington. Several central-banker appearances are scheduled, with speeches by the governors of Spain, France and Germany, as well as the Bank of England chief Andrew Bailey.

Data will be correspondingly light. For the euro region, the highlight may be industrial production on Wednesday, which may give an indication of the strength of growth during the second quarter. Final estimates of inflation in major economies are also expected.

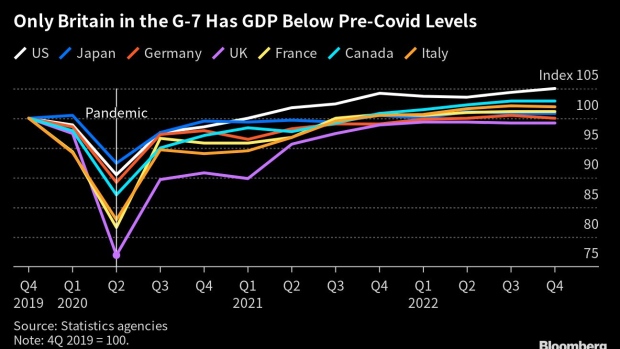

The UK, meanwhile, will release monthly gross domestic product for February, which will give another indication of whether a recession is being avoided.

Turning to the Nordic region, inflation data will be released throughout Scandinavia. Sweden’s number on Thursday may attract particular focus, with a drop in the headline rate expected, yet that may not be enough to deter further hikes in borrowing costs by the Riksbank.

Looking south, Egyptian inflation due Monday is likely to show another acceleration but potentially at a slower pace after the state intervened on food supplies and moderated prices.

Data on Wednesday may show Ghana’s inflation rate in March fell below 50% for the first time in five months on the back of a stable currency and base effects.

On Friday, data from Nigeria will probably show that price growth softened in March, due to cash shortages affecting the ability to spend by businesses and consumers alike.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

If President Luiz Inacio Lula da Silva was furious at Brazil’s central bank over high rates when inflation was near 6%, what happens when it falls back to within the 1.75%-to-4.75% target range, as some economists expect with the March data?

Hard to say, but Lula’s focused on jump-starting the economy of Latin America’s slumbering giant, and so may be less than keen to hear how base effects are driving a short but pronounced bout of disinflation and that year-end inflation of 6% is a good bet.

The minutes of Banxico’s March meeting may do little more than affirm the data-dependent stance policymakers adopted in their post-decision statement, issued after a quarter-point hike to 11.25%.

Peru’s central bank on Thursday is likely to keep its key rate at 7.75% for a third month. Julio Velarde, Latin America’s longest-serving central bank chief, said in March that inflation in the Andean nation may well fall back to the top of the 1%-to-3% target range by year-end.

Wrapping up the week, Argentine inflation is widely expected to have accelerated for a 14th month from February’s 102.5% reading, shaking off currency controls, multiple exchange rates and price freezes on thousands of items.

The median estimate of 17 analysts surveyed by Bloomberg puts the year-end rate at 100%, which would be the 16th triple-digit print since 1974.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Robert Jameson, Malcolm Scott, Michael Winfrey, Paul Richardson, Monique Vanek, Stephen Wicary and Erik Hertzberg.

©2023 Bloomberg L.P.