Nov 13, 2023

US Consumers Trim Inflation Expectations and Outlook for Finances Is Mixed

, Bloomberg News

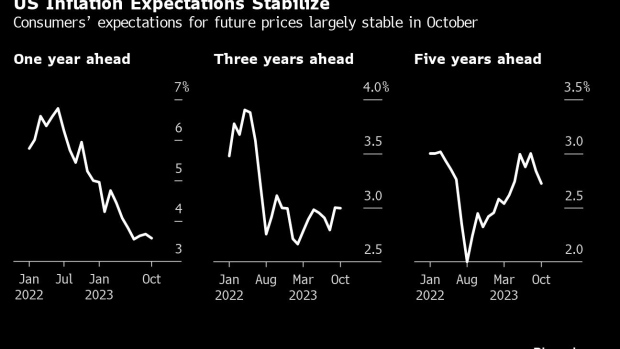

(Bloomberg) -- US consumers’ near-term inflation expectations dropped slightly in October and their outlook about their finances was mixed, according to a Federal Reserve Bank of New York survey.

Median one-year-ahead inflation expectations dropped slightly last month to 3.6% from 3.7% in September, the New York Fed said Monday. Expectations for what inflation will be at the three-year horizon remained steady at 3%. And the outlook for inflation in five years ticked down to 2.7% from 2.8%.

The report showed consumers have mixed views about their ability to access credit and find work. A smaller share of respondents reported finding it more challenging to access credit now than a year ago. But a larger share of people said they expected to see tighter credit conditions in one year.

As for the jobs market, the perceived odds of losing a job in the next year rose by 0.3 percentage point to 12.7% and the probability of finding a job after becoming unemployed rose slightly to 56.6% from 56.5%.

Fed officials are trying to determine if they should raise borrowing costs further to bring inflation down to their 2% target, or if their past rate moves — combined with a recent increase in long-term Treasury yields — will be sufficient.

Read More: US CPI Is Seen Getting a Nudge From Swing in Health Insurance

An update Tuesday on the consumer price index, which is different from the Fed’s preferred inflation metric, should help to inform policymakers before their next gathering on Dec. 12 and 13. The monthly and annual measures of overall CPI are expected to slow in October on retreating gasoline costs. But excluding energy and food prices, the core metric is seen staying at levels above the Fed’s target.

A separate report released last week by the University of Michigan found that consumers’ long-term inflation expectations increased to the highest since 2011 and that people are becoming more concerned about high borrowing costs and the economy’s prospects.

The New York Fed monthly survey of consumer expectations showed households expect prices to rise more rapidly for gas and medical care. Expectations for how much the cost of rent and food will rise over the next year held steady at at 9.1% and 5.6% respectively.

--With assistance from Alex Tanzi.

©2023 Bloomberg L.P.