Mar 10, 2023

US-EU Seek Deal on Minerals Used in EVs in Race for Green Investments

, Bloomberg News

(Bloomberg) -- The US and European Union are seeking a preliminary agreement on the supply of so-called critical minerals used in electric vehicles, a step toward Washington’s efforts to reduce the global reliance on China for materials necessary for green-energy technologies.

The agreement, if finalized, also has a shorter-term benefit of defusing a trade dispute between the US and Europe by allowing EU companies access to some of benefits included in President Joe Biden’s massive climate-subsidy plan.

“We have agreed that we will start work now with a clear goal — the goal is to have an agreement on critical raw materials that have been sourced, or processed in the European Union,” European Commission President Ursula von der Leyen told reporters in Washington Friday where she met Biden for discussions.

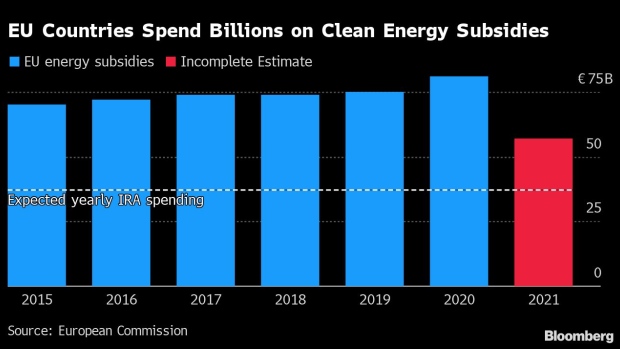

The EU has been seeking concessions from the law, known as the IRA, which will offer as much as $369 billion in handouts and tax credits over the next decade for clean-energy programs in North America. Von der Leyen has said that aspects of the bill would unfairly help US firms and was seeking an exemption for European companies.

“We’re driving new investments to create clean-energy industries and jobs, and make sure we have supply chains available to both our continents,” Biden said earlier Friday. “The idea underpins our Inflation Reduction Act. And it lies at the heart of your Green Deal Industrial Plan.”

The White House is prioritizing access to minerals such a lithium, nickel and cobalt needed for electric-vehicle batteries as it pushes an ambitious climate plan. That includes both boosting the use of EVs as well as building those automobiles and their supply chains in the US.

That requires a generational overhaul in American carmaking and manufacturing, as well as ramping up supplies and technology dominated by China, which the US sees as its top competitor and an unreliable trade partner.

‘Enormous’ Demand

“The global demand for these minerals in the years to come will be enormous. And we’re highly dependent on China,” Treasury Secretary Janet Yellen said earlier Friday during testimony in the House Ways and Means Committee. “One of the goals of the IRA is to broadly strengthen supply chains for these critical minerals and their processing.”

The agreement with the EU, which she said is also being discussed with Japan, would “permit our close allies to also contribute minerals and their processing that would be eligible for use in electric vehicles that are assembled in North America.”

The US and the EU also agreed to create a new mechanism to avoid disputes over the green subsidies, called the Clean Energy Incentives Dialogue, they said in a statement. “Both sides will take steps to avoid any disruptions in transatlantic trade and investment flows that could arise from their respective incentives,” they said.

The two also plan to reach an agreement on sustainable steel and aluminum supplies by October, another initiative aimed at isolating China, a massive supplier of both materials.

Limit Exports

The statement also touched on other efforts the US and EU are taking to limit certain technology exports to China, which have recently been dominated by equipment and knowhow needed to make semiconductors.

“We are increasing our cooperation to prevent the leakage of sensitive emerging technologies, as well as other dual-use items, to destinations of concern that operate civil-military fusion strategies,” they said. “Our respective existing controls related to exports, inbound investment, and research cooperation are essential tools and need to be upgraded to correspond to a changing geostrategic environment.”

The Inflation Reduction Act’s focus on spurring American industry angered trade partners from Asia and Europe who saw it cutting them out of the US market, particularly for automobiles. It includes a lucrative $7,500 consumer-tax credit for EVs that meet certain requirements.

The critical-mineral deal would grant the EU equivalent status as an American free-trade partner under the law, allowing European-made battery components or materials to be used in EVs eligible for US tax credits. The Treasury Department has also signaled that European vehicles used commercially or leased would qualify, which has also eased tensions between the allies.

The allies plan to immediately start talks on a deal “for the purpose of enabling relevant critical minerals extracted or processed in the EU to count toward requirements for clean vehicles in the section 30D clean-vehicle tax credit of the IRA,” they said in the statement.

“This kind of agreement would further our shared goals of boosting our mineral production and processing and expanding access to sources of critical minerals that are sustainable, trusted, and free of labor abuses,” they said. “Cooperation is also necessary to reduce unwanted strategic dependencies in these supply chains, and to ensure that they are diversified and developed with trusted partners.”

The implementation of the law and appeasing Europe, meanwhile, has drawn the ire of Congress, which has questioned the White House’s authority to use a deal on minerals as the equivalent of a trade agreement. As well, members including Senator Joe Manchin have blasted any effort to allow non-American companies to benefit from the law. That includes Chinese firms, which dominate the EV industry, form participating in joint-ventures based in the US, such as Ford motor Co.’s planned battery tie-up with Contemporary Amperex Technology Co. in Michigan.

Even though opinions have moderated in the EU regarding the effect the IRA will have on European companies, some officials still warn that parts of the law are discriminatory in nature and could draw clean-tech investment away from the bloc.

Some European Commission officials said that the American law will build a “new industrial ecosystem” and poses a danger to Europe’s competitiveness, according to its initial assessment of the law seen by Bloomberg. It also identified more than $25 billion of company spending heading to the US and China, rather than Europe.

Von der Leyen has put forward the Green Deal Industrial Plan, which includes simplifying regulations and speeding up permits for new projects, as a way to compete with the US.

(Updates with plan for new mechanism to avoid disputes on subsidies in 10th paragraph.)

©2023 Bloomberg L.P.