Mar 1, 2023

US Manufacturing Shrinks at Slower Pace; Prices Gauge Jumps

, Bloomberg News

(Bloomberg) -- A gauge of manufacturing improved for the first time in six months, though activity remained in contraction territory amid fragile demand and growing inflationary pressures.

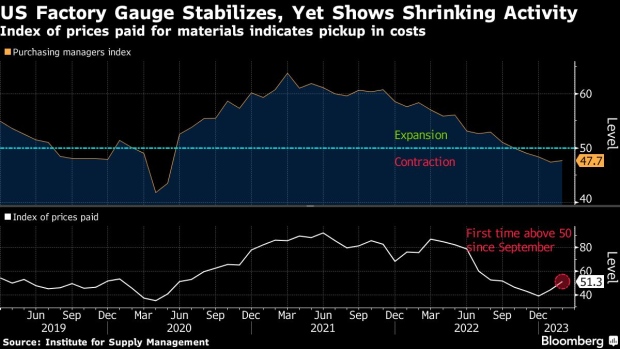

The Institute for Supply Management’s gauge of factory activity ticked up to 47.7 in February from the weakest print since May 2020. The median estimate in a Bloomberg survey of economists was for 48. Readings less than 50 indicate contraction.

The latest data, released Wednesday, highlight a manufacturing sector that’s struggling for a foothold. While household demand rebounded at the start of the year, rising interest rates, higher input costs and looming concerns of an economic downturn remain persistent headwinds.

Fourteen industries reported contraction in February, led by the printing, paper and wood products industries. Four sectors expanded.

“New order rates remain sluggish due to buyer and supplier disagreements regarding price levels and delivery lead times; the index increase suggests progress in February,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement. “Panelists’ companies continue to attempt to maintain headcount levels through the projected slow first half of the year in preparation for a stronger performance in the second half.”

The group’s measure of prices paid for materials rose for a second month. At 51.3, it was the first time since September that the figure indicated rising costs. The share of respondents reporting they paid higher prices rose to about 25%, also the highest in five months.

The step-up in input prices comes on the heels of data last week that showed the Federal Reserve’s key inflation gauges accelerated at the start of the year. Stubborn price pressures are expected to lead policy makers to pursue several more interest-rate hikes in the coming months.

ISM’s new orders index rose in February by the most since 2020, while the production gauge slipped to 47.3. Even with the improvement, the gauge of bookings remained below 50, indicating orders continued to shrink in the month. Inventories were little changed.

Select Industry Comments

“Good start to the year for bookings. Electronic components, specifically processors, continue to be challenging due to the risk of not hitting the commit dates, even with the extended lead times quoted.” - Computer & Electronic Products

“A slowdown in new housing construction and concerns of a slowing economy have customers delaying purchases in an effort to destock.” - Chemical Products

“Sales remain solid, and most assembly plants are running at capacity. “ - Transportation Equipment

“Expect the first half of 2023 in the US to be slower than the second half. Expect slower orders throughout 2023 for Europe.” - Food, Beverage & Tobacco Products

“Even though our number of quotes are down, we are still staying busy, and our backlog has a lot to do with it. A backlog of 30-plus weeks is not ideal.” - Machinery

“Business and new orders are softening, and customers are pushing out current orders.” - Plastics & Rubber Products

“New orders are steady; production has been running consistently for several months.” - Electrical Equipment & Appliances

“New orders are still strong; however, we continue to experience price increases (although at a slower rate than a year ago), which we have not accounted for in this year’s budget.” - Fabricated Metal Products

“Business conditions are still strong; however, inventory has exceeded our planned levels. This will impact operations until the inventory situation is resolved.” - Primary Metals

“While there are lingering concerns about a recession, we are not expecting a large drop-off in manufacturing this year. Worst case is flat.” - Nonmetallic Mineral Products

The ISM’s manufacturing employment measure fell to 49.1 in February, suggesting headcount declined in the month. The monthly government employment report will be released March 10 and will give a fuller picture of the job market in the month.

--With assistance from Kristy Scheuble.

(Adds share reporting paying higher prices)

©2023 Bloomberg L.P.