Dec 20, 2022

US Recession Is Key to Whether BOJ-Fueled Treasury Selloff Lasts

, Bloomberg News

(Bloomberg) -- Treasuries slumped for a third straight day Tuesday in the wake of a surprise tweak by the Bank of Japan to its policy of yield curve control that fueled debate about whether a nascent rally in bond markets is now over or just on pause.

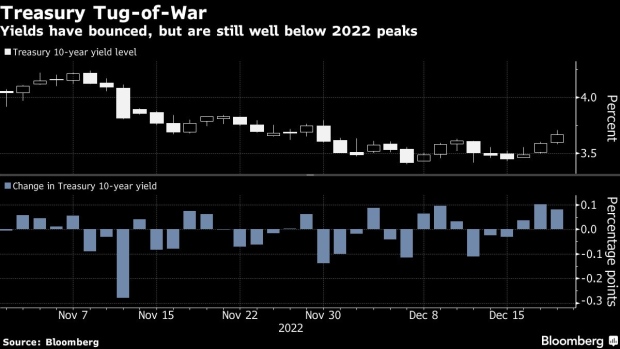

With US recession risks swirling, questions around inflation unresolved and the path of Federal Reserve policy up in the air, investor appetite for Treasuries could well persist. While the shift up in US yields in the past couple of days has been substantial, 10-year Treasury rates are still down more than three-quarters of a point below their 2022 peak.

“It’s pretty likely that, at least for this cycle, that we’ve already seen the peaks in Treasury yields,” said Tom Graff, head of investments at Facet Wealth, a Baltimore, Maryland-based firm that manages about $1.5 billion of client money. “The economy going into recession is very likely – or at least a slowdown for sure. It would be unusual to see the 10-year yields really rise in the face of a recession.”

The US 10-year yield jumped as much as 12 basis points to 3.71%, adding to Monday’s advance, before ending the day at 3.68% The move followed an increase of around 15 basis points in the Japanese government bond market, which took the 10-year rate there to around 0.40%.

There has long been speculation among investors about whether an eventual shift by the BOJ away from its longstanding policy of ultra-low rates — the last major central bank yet to do so — might remove a key anchor from global bond markets, turbocharging the liftoff that’s been driven by the Federal Reserve, the European Central Bank and others.

“Each incremental increase in the YCC band will be a bearish impulse for the US,” BMO Capital Markets rate strategists Ian Lyngen and Ben Jeffery wrote in a note to clients. However, “the law of diminishing bearishness applies as the ‘shock’ value of the current move will be the highest” and there is a limit to how elevated JGB yields will impact US rates, they wrote.

This move by the BOJ, of course, is not an abandonment of near-zero policy, it is a tweak to its yield-curve control mechanism that allows market rates on bonds to move a bit higher. Its primary policy benchmark remains stuck at minus 0.1% and while the range of permitted fluctuation for the 10-year yield is bigger, it’s still officially aiming to keep that around zero too. But it is seen, by some, as a signal of the path toward unwinding, so the reaction of markets is instructive.

“The prevailing view is that the BOJ has executed brilliantly,” said Greg Peters at PGIM. “The relatively muted JGB reaction and move in the yen was done quite well. The muted beta to US Treasuries makes sense.”

All else being equal, the move by BOJ Governor Haruhiko Kuroda to allow Japan’s government bond yields to go higher should encourage more of the country’s capital to stay or return home, potentially removing some appetite for US securities by one of the world’s biggest holders of Treasuries. Indeed, that is evident in the jump in the yen following the BOJ’s announcement.

Read more: Treasuries Positioning Purge Gives Green Light for Higher Yields

However, from the perspective of Treasuries, Japanese investors have already been net sellers for much of this year even as the market has rallied, and hedging costs — driven in large part by central bank rate differentials — have been elevated.

The tide has shifted more generally within the Treasury market and there is a host of tailwinds for bonds to counteract the bearish impulse from Japan. The Fed’s hawkishness has potentially peaked. Rising US recession risk is likely to spur haven demand next year. Central-bank reserve selling, which had reached extreme levels and weighed on Treasuries, is also abating as easing commodity prices take pressure off commodity importers, including Japan.

On top of that, there are signs that Treasuries are still oversold, at least by historical standards, and that positioning remains short on a net basis, providing potential fuel for buying. Just how the changes in Japan ultimately play into that remain to be seen.

“On the margin” the move is likely to temper demand for Treasuries and other US debt, said Brian Svendahl, Minneapolis-based senior portfolio manager of BlueBay US fixed income at RBC Global Asset Management. “To me this is more of a longer term story rather than a short term shock.”

(Updates pricing, adds strategist comment.)

©2022 Bloomberg L.P.