Mar 3, 2023

US Service Sector Expands More Than Forecast Suggesting Hiring Success

, Bloomberg News

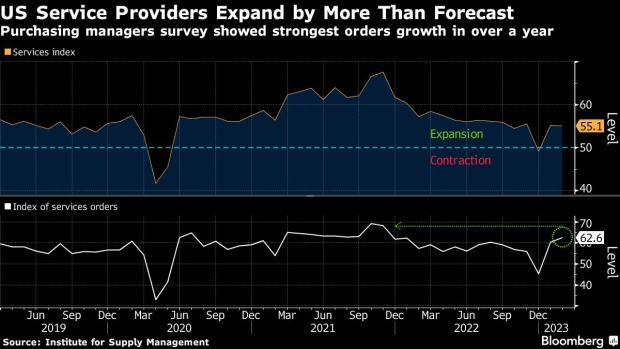

(Bloomberg) -- The US service sector expanded in February by more than forecast as a measure of orders climbed to a more than one-year high and hiring increased.

The Institute for Supply Management’s gauge of services was little changed at 55.1, according to data out Friday. Readings above 50 signal growth and the February index exceeded the median forecast of 54.5 in a Bloomberg survey of economists.

The purchasing managers group’s measure of new orders rose more than 2 points to 62.6, the highest since November 2021 and signaling healthy demand. The index of services employment increased 4 points to a more than one-year high of 54.

The advance suggests service providers are having more success hiring after experiencing difficulty attracting workers throughout the pandemic. Government data next Friday will provide further clues into the state of hiring across the entire economy.

The ISM report is the latest indication of still-healthy demand for services against a backdrop of a resilient labor market and a steady rotation away from spending on goods. At the same time, rising credit-card debt, persistent inflation and higher interest rates are potential hurdles for households.

‘Mostly Positive’

“Respondents indicated that they are mostly positive about business conditions,” Anthony Nieves, chair of the ISM Services Business Survey Committee, said in a statement.

“Suppliers continue to improve their capacity and logistics, as evidenced by faster deliveries. The employment picture has improved for some industries, despite the tight labor market. Several industries reported continued downsizing,” he said.

Thirteen services industries reported growth last month, including agriculture, construction and retail trade. Four reported a decline in activity, led by wholesale trade, transportation and warehousing, and information.

The gauge of prices paid by service providers for inputs continued to show costs rising, albeit at a slower pace. While falling to the lowest level in more than two years, at 65.6, the index is well higher than the gauge of prices paid by manufacturers and indicates persistent inflation.

The group’s business activity index, which parallels the ISM’s factory output gauge, retreated last month but continued to show a solid pace of expansion.

Select ISM Industry Comments

“Sales activity is generally strong, despite economic headwinds.” - Accommodation & Food Services

“Activity is steady. Costs continue to escalate, eliminating any profit we had hoped for in the first and second quarters.” - Construction

“Upward pricing pressures have eased slightly but are still elevated.” - Finance & Insurance

“Inflation, though somewhat eased from the peaks of the past six months, continues to drive higher-pricing demands from suppliers.” - Health Care

“Most industries are being pinched by inflation and more expensive labor markets. Before, cost reduction was the goal; it’s now cost avoidance. That said, since we’re not able to reduce cost to maintain margins, we have to reduce the employee base more aggressively to achieve margins.” - Information

“Generally flat activity level.” - Mining

“Continual effort to right-size inventory to match lower sales forecasts for the coming year.” - Retail Trade

The overall services purchasing managers index was also restrained by a decline in the supplier deliveries gauge, which fell to the lowest level since mid-2009 during the Great Recession. The measure dropped back below 50, indicating quicker delivery times and a further easing in supply-chain problems.

The service sector also enjoyed firmer demand from abroad in February as the exports index advanced to a five-month high.

--With assistance from Jordan Yadoo.

(Adds ISM industry comments)

©2023 Bloomberg L.P.