Aug 4, 2023

US Treasury Market Topped Record $25 Trillion in July

, Bloomberg News

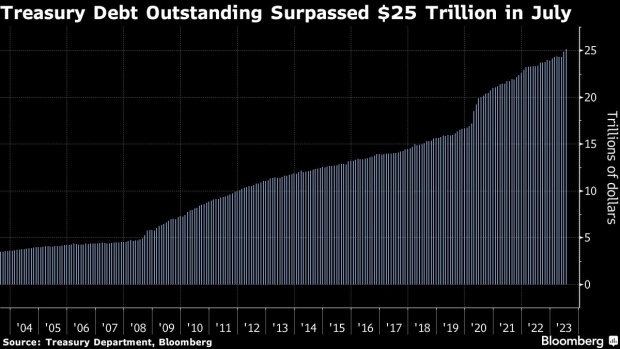

(Bloomberg) -- The US government is on the hook to investors for more than $25 trillion as it ramps up borrowing to plug a widening budget gap.

The combined total amount of Treasury bills, notes and bonds outstanding increased by about 1% during July to a record $25.137 trillion, according to data released Friday. It’s poised to continue to mount.

As recently as June 2020, total marketable debt outstanding was under $20 trillion. It was under $15 trillion as recently as June 2018. Borrowing increased sharply in 2018 to finance tax cuts and surged in 2020 to finance the federal pandemic response. Now it’s expanding in part because higher interest rates have inflated the cost of servicing the existing debt. Also, the outlook for the federal budget deficit has worsened.

Next week’s quarterly auctions of new 10-year notes and 30-year bonds will be larger than the previous ones for the first time in more than two years.

Concerns about whether investor appetite will materialize for the new crop of auctions — which also includes planned increases to the other notes and bonds the US government sells, as well as to short-term bills — weighed on the Treasury market this week, pushing yields on the longest-maturity issues to the highest levels of the year.

Most of the increase in July was in the form of bills, which the Treasury Department typically expands first when its borrowing needs rise.

©2023 Bloomberg L.P.