Jan 31, 2022

Viking Hedge Fund Blames 2021 Losses on ‘Underestimating’ Covid

, Bloomberg News

(Bloomberg) -- After posting its worst ever performance last year, Viking Global Investors is trying to explain its losses -- and it’s pinning the blame on the Covid-19 pandemic.

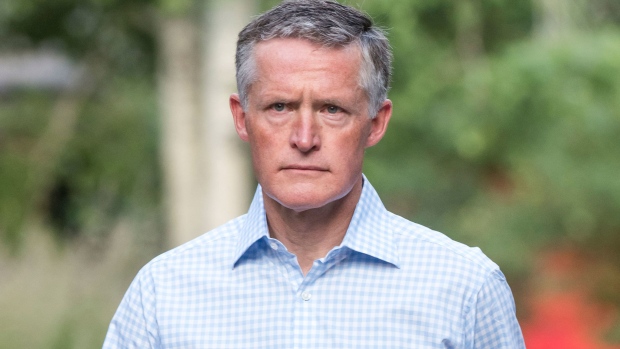

The firm’s hedge fund, which invested in 2021 laggards such as Peloton Interactive Inc., Coupa Software Inc. and Adaptive Biotechnologies Corp., fell 4.5% in the year because it “underestimated the ongoing impact of Covid,” founder Andreas Halvorsen wrote in a letter to investors dated Jan. 18.

Viking has been one of the hedge fund world’s biggest successes since its founding in 1999, registering only four down years, including the most recent one. But it suffered because of its bet that consumer spending would normalize, and that shoppers would shift back toward services such as travel and elective medical procedures.

“In hindsight, these were bad bets,” Halvorsen said in the letter. But, he added, “we have maintained our positioning and believe companies exposed to reopening will benefit from both an improvement in fundamentals and a re-rating of multiples.”

The hedge fund continued to struggle amid this month’s stock market decline -- the S&P 500 is down about 6% -- losing 5.7% through Jan. 21, according to a person familiar with the matter.

A representative for Greenwich, Connecticut-based Viking, which runs nearly $47 billion, declined to comment.

Viking’s sizable wager on Peloton was one of its biggest losers. The stock, an early pandemic winner, fell 76% last year as results didn’t match expectations. Viking has since “substantially cut” the size of its position, Halvorsen said. Coupa Software and Adaptive Biotechnologies both fell by more than 50%, and wagers in the communication services and IT sectors also generated “absolute losses on the long side,” the letter said.

Halvorsen added that poor portfolio construction played a part in the performance letdown. After the retail-investor short squeeze in January 2021, Viking liquidated or scaled back several short bets that it thought could be susceptible to similar moves, and added to some long positions. But that led to its holdings becoming “increasingly mismatched” -- several of the long companies were unprofitable, while the short targets enjoyed good earnings.

Meanwhile, Viking’s long-only strategy rose 8.3% last year, according to Halvorsen’s letter. On the private side, its Global Opportunities Hybrid fund, which invests in both stocks and private companies, returned about 20% in 2021, according to a person familiar with the matter.

Viking, believing private investment opportunities are “robust,” is increasing its wagers in the space and opening Global Opportunities to new cash, Halvorsen said in the letter.

©2022 Bloomberg L.P.