Jun 14, 2022

Volatility grips stocks as Treasury yields jump

, Bloomberg News

Canada is the best place to be for equities: Martin Pelletier

Volatility continued to grip financial markets on concern the Federal Reserve’s aggressive stance to fight stubbornly high inflation will throw the world’s largest economy into a recession.

After facing many twists and turns, the S&P 500 closed down for a fifth straight day -- its longest losing streak since January. The technology-heavy Nasdaq 100 climbed as Oracle Corp.’s forecast suggested the effort to move customers to the cloud is gaining momentum. Economic bellwether FedEx Corp. soared after boosting its dividend.

Treasuries extended their worst rout in decades, with two-year yields hitting a level last seen in 2007. Traders remained cautious ahead of the US central bank’s decision Wednesday and have now almost fully priced in a 75-basis-point hike, the biggest since 1994. In just three days, two-year rates have increased more than 60 basis points, the most since 1987. A closely watched part of the US curve inverted briefly, signaling concerns that restrictive policy may take a bigger toll on the economy. The dollar rallied, the Japanese yen sank to a 24-year low, while the pound slid to its lowest since March 2020.

“There will be an elevated level of volatility,” wrote Jim Caron, portfolio manager and chief fixed-income strategist at Morgan Stanley Investment Management. “While the Fed’s primary goal is to reduce wage inflation, this may instead deflate asset prices.”

Investor fears of stagflation are at the highest since the 2008 financial crisis, while global growth optimism has tumbled to a record low, according to Bank of America Corp.’s monthly fund manager survey. Global profit expectations also dropped to 2008 levels, with BofA strategists noting that prior troughs in earnings expectations occurred during other major Wall Street crises, such as the Lehman Brothers bankruptcy and the bursting of the dot-com bubble.

More Comments:

- “The volatility today is a testament to the uncertainty going into the FOMC meeting as well as concerns about the impact such an aggressive ramp of tightening could have the economy,” said Seema Shah, chief global strategist at Principal Global Investors, referring to the Federal Open Market Committee. “The 75-basis-point possibility was a far-flung risk this time last week, so market participants are having to quickly revisit Fed, economy and market forecasts.”

- “This is one of those environments where it is getting rougher,” said Jason Pride, chief investment officer of private wealth at Glenmede. “In our index, we’re seeing some nascent, but I would argue, not fully-throated signs of oversold conditions. So it’s flashing like this weird and somewhat inconvenient weak buy signal -- as opposed to like some sort of really strong oversold capitulation, high-conviction buy signal.”

- “New money should be patient money as investment psychology has shifted to the negative side,” said George Ball, chairman of Sanders Morris Harris. “It’s better to miss the bottom of a market and buy on the way up than to guess where the exact bottom is.”

- “Fed rate hikes and global central bank tightening will bring about slower growth,” wrote Dennis DeBusschere, the founder of 22V Research. “The question is how fast growth needs to slow to generate a policy-friendly inflation trend. Slower growth that doesn’t trigger a sharp recession, should lead to both lower 10-year yields and a lower equity risk premium. Under that backdrop, there is a good amount of upside to equities.”

The smart money dumped stocks at the fastest pace on record as a vicious selloff sent the S&P 500 into a bear market, following a plunge of over 20 per cent from a record. Hedge funds tracked by Goldman Sachs Group Inc. offloaded US equities for a seventh straight day Monday, with the dollar amount of selling over the last two sessions exploding to levels not seen since the firm’s prime broker began tracking the data in April 2008.

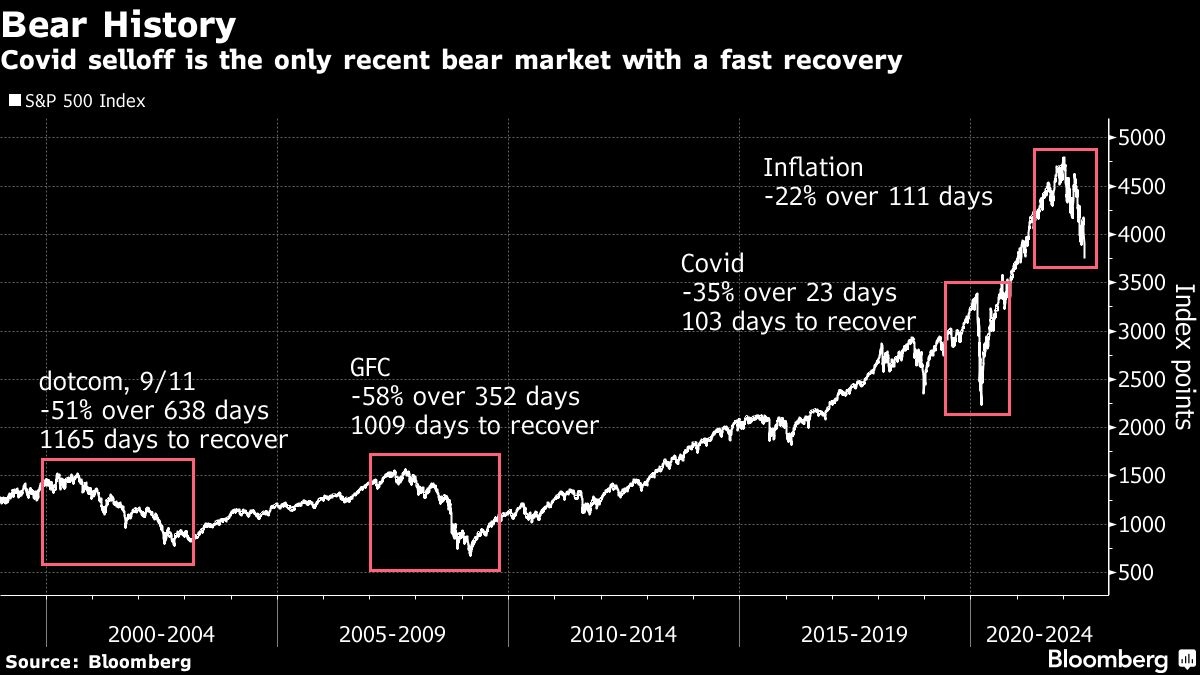

It’s the fourth bear market for the S&P 500 over the past two decades, and history shows that it will likely take time for US stocks to rebound. While the COVID-19-fueled slump of 2020 was followed by a rapid recovery, other bear markets took much longer to bounce back. The gauge fell 51 per cent from peak to trough from 2000 to 2002, and by 58 per cent during the global financial crisis. In both of those cases, it took more than 1,000 trading days to claw back the losses.

Elsewhere, US natural gas futures plummeted and European prices surged after the operator of a key Texas export terminal said it may take three months to partially restart the facility following a fire last week.

What to watch this week:

- FOMC rate decision, Chair Jerome Powell briefing, US business inventories, empire manufacturing, retail sales, Wednesday.

- ECB President Christine Lagarde due to speak, Wednesday.

- Bank of England rate decision, Thursday.

- US housing starts, initial jobless claims, Thursday.

- Bank of Japan policy decision, Friday.

- Eurozone CPI, Friday.

- US Conference Board leading index, industrial production, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.4 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 0.2 per cent

- The Dow Jones Industrial Average fell 0.5 per cent

- The MSCI World index fell 0.7 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.4 per cent

- The euro was little changed at US$1.0415

- The British pound fell 1.2 per cent to US$1.1987

- The Japanese yen fell 0.6 per cent to 135.20 per dollar

Bonds

- The yield on 10-year Treasuries advanced 11 basis points to 3.47 per cent

- Germany’s 10-year yield advanced 13 basis points to 1.76 per cent

- Britain’s 10-year yield advanced six basis points to 2.59 per cent

Commodities

- West Texas Intermediate crude fell 2.1 per cent to US$118.34 a barrel

- Gold futures fell 1.3 per cent to US$1,808.60 an ounce