Jan 17, 2023

Wall Street Abandons Bearish Euro Calls as Outlook Mellows

, Bloomberg News

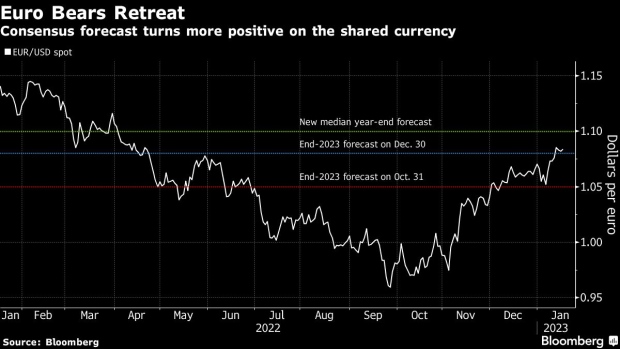

(Bloomberg) -- One after another, bank strategists are abandoning their bearish euro predictions in 2023.

JPMorgan Chase & Co. analysts are the latest to give up their call for the shared currency to linger below dollar parity. Morgan Stanley strategists upped their year-end projection to $1.15 after their earlier $1.08 call was hit last week. An ING Groep NV team gave their forecast “a factory reset.”

With the euro rising amid a brighter economic outlook, Wall Street is adjusting year-ahead outlooks by the most since 2015, according to data on median end-2023 forecasts compiled by Bloomberg since the close of December. The projection now stands at $1.10, playing catch-up to the currency that’s already above $1.08.

“To quote a former UK Prime Minister when asked about the most significant challenges faced by his administration, the answer came: ‘Events, dear boy, events,’” wrote the ING team led by Chris Turner, which now sees the euro hitting $1.15 next quarter, versus an earlier forecast of parity. “The same can be said for foreign exchange strategists making FX forecasts.”

The drop in energy prices, China’s economic reopening and growing signs growing that the Federal Reserve may slow its rate hikes are helping the euro advance, defying bleaker expectations.

On Tuesday, European Central Bank Governing Council member Mario Centeno said the euro-area economy is performing better than many anticipated in the face of record inflation and the energy crisis that erupted after Russia attacked Ukraine.

Some are still skeptical that the rally has further to run. The JPMorgan team changed their forecasts from $0.95-$1.00 to $1.08-$1.10, citing a rebound in the region’s economic growth momentum, but say more is needed before they can turn outright bullish.

“We are shying away from chasing this move higher in a durable way,” said analysts including Meera Chandan. “The energy dependence issues haven’t magically dissipated. This is likely to be a multi-year structural adjustment, the full ramifications of which are still unfolding.”

--With assistance from James Hirai.

©2023 Bloomberg L.P.