Oct 3, 2022

Wall Street capitulation calls get ever harder as U.S. stocks bounce

, Bloomberg News

Markets rally to ring in Q4, but it probably won't last

After a furious spate of retail selling unseen since December 2018 and beaten-down risk appetite, all the ingredients were in place heading into the big stock rebound Monday.

With almost everyone cashing out lately, it didn’t take much to drive the 2.6 per cent gain in the S&P 500 in an everything-rally attributed to hopes of a less-hawkish Federal Reserve and the fading U.K. market crisis.

A constituency that will be less pleased by the rebound: Wall Street pros who have been agitating for signs of full-on investor surrender to the bear market in order to signal a bottom for equities.

Thanks to a prolonged but orderly selloff that has forced dip buyers to fold one after another, the traditional climax seen in typical downturns -- a dramatic surge in negative sentiment across the industry -- may not happen this time round, according to JPMorgan Chase & Co.’s sales trading team.

“While we could still see further de-risking, it’s possible we don’t get a clear sign of broad capitulation (i.e. where most investors sell strongly at the same time) because positioning is already quite low,” the JPMorgan team including John Schlegel wrote in a note.

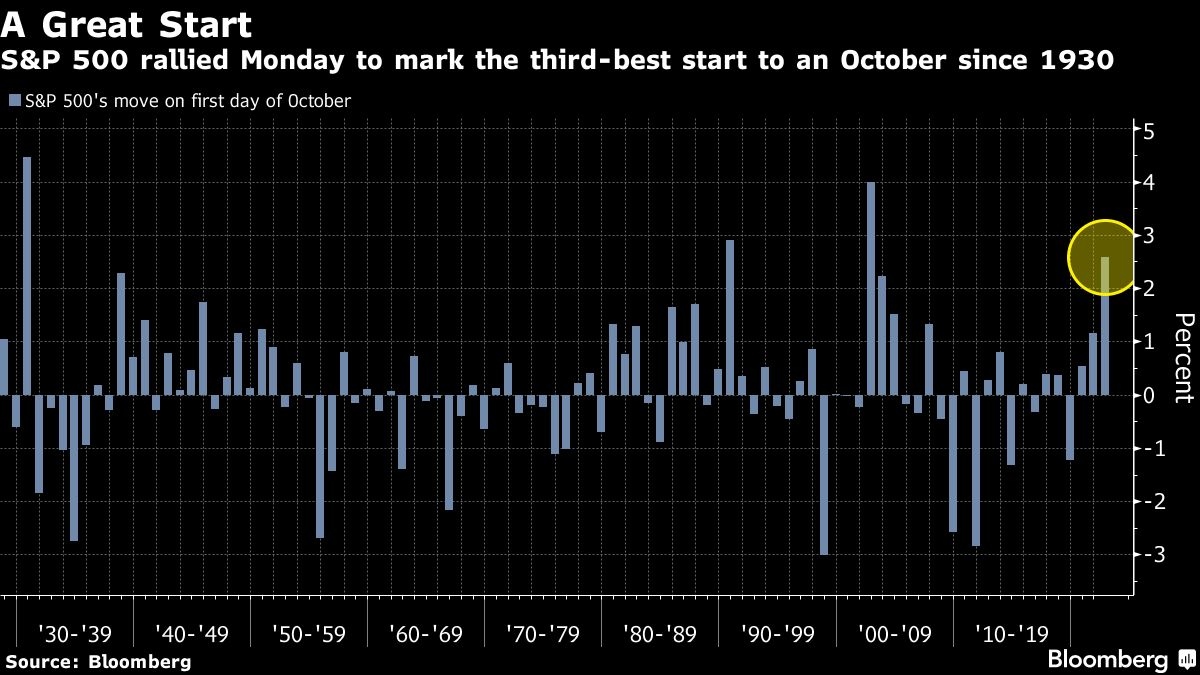

The S&P 500 notched its third-best start to an October since 1930, halting a three-week, 12 per cent slump.

Between weak US manufacturing data and fears over the negative spillovers of hawkish US monetary policy on the rest of the world, hopes are creeping up that the Fed could slow or pause its inflation-fighting campaign.

In the view of Ed Yardeni, the president of Yardeni Research, things are already breaking in markets, as signaled by a relentless rally in the dollar, and the Fed should consider stopping tightening after one more interest-rate hike in November. He pointed to Bank of England’s dramatic market intervention last week to stem a collapse in the British pound and U.K. government bonds as a possible template for other policy makers to follow.

While it’s certainly debatable whether the Fed will put global financial stability as a priority ahead of its inflation goal, a small shift in narratives appeared to be enough to spark a rally when almost everyone is a bear.

Gauging the state of capitulation has become Wall Street’s pastime of late after a nine-month slump wiped out US$15 trillion in equity values. While bulls like Deutsche Bank AG strategist Binky Chadha cited depressed positioning as a reason for a potential giant year-end rally, his counterpart at Bank of America Corp., Savita Subramanian, said Wall Street sentiment has yet to get fully washed out.

The rationale behind such exercises is the idea that when everyone is rushing for exit, that leaves a smaller pool of traders to sell stocks, thereby forming a floor for the market. Many tools have been designed to measure sentiment, including metrics on positioning, trading volume and volatility.

Among hedge funds tracked by Morgan Stanley, net leverage -- a gauge of risk appetite that takes into account the group’s long versus short position -- last week touched a 13-year low. Meanwhile, trend followers like Commodity Trading Advisors saw their equity positioning approaching the trough seen at the hight of the global financial crisis, JPMorgan data show.

When shares tumbled to fresh bear market lows last month, the rush for exit was mostly absent. Yes, retail investors, based on JPMorgan estimates, dumped the most in single stocks in data going back to 2015. And separate data compiled by Morgan Stanley show they sold shares on 75 per cent of the days, the highest frequency of disposals since December 2018.

But broadly speaking, there was no sign of panic selling. Trading volume exceeded 12 billion shares on Friday, but that paled in comparison to mid-June, when about 19 billion shares changed hands.

The reaction in the Cboe Volatility Index, or VIX, that’s known as Wall Street’s fear gauge, was also subdued. Despite an advance, the VIX has failed to take out its June high.

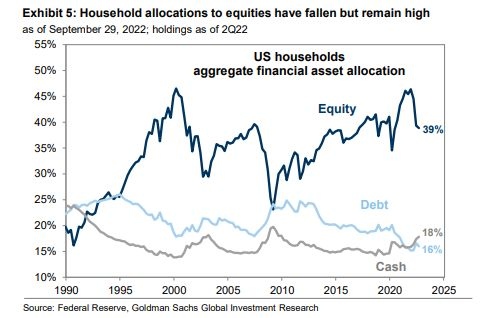

To Goldman Sachs Group Inc.’s Tony Pasquariello, there is more room for US households to cut their stock ownership. According to the firm’s data, the group’s allocations to equities stand at 39 per cent -- still high relative to history.

“The job of a trader, of course, is to weigh this ongoing corrosion of the fundamental outlook and the cocktail of risk against the vivid markings of a stock market that is both technically oversold and tactically under-owned,” Pasquariello wrote in a note last week. “I believe we’ve seen genuine capitulation in the hedge fund community. On the other side of the coin, US households are still quite full of length.”