Aug 17, 2023

Walmart lifts profit outlook again on boost from bargain seekers

, Bloomberg News

Competition aside, Amazon and Walmart are on different race tracks: Former Sears Canada CEO

Walmart Inc. raised its annual profit forecast for the second straight quarter after scoring new sales gains with bargain-hunting U.S. shoppers.

Food revenue continued to rise strongly and Walmart's general merchandise business was stronger than the company expected at the beginning of the second quarter, said Chief Financial Officer John David Rainey. The retailer is also still benefiting from stepped-up demand among higher-income customers.

“We're gaining share and our value proposition continues to resonate, both for value and convenience,” Rainey said in an interview Thursday as Walmart reported results for the three months ended in late July. “The consumer is still spending, but they're being discerning in their spending.”

The improved forecast underscores the resilience of Walmart's massive grocery business, which is enabling the company to grab more sales even as consumers think twice before buying discretionary goods. Earlier this week, Target Corp. and Home Depot Inc. reported comparable-sales declines as consumers continued to pull back from nonessential items.

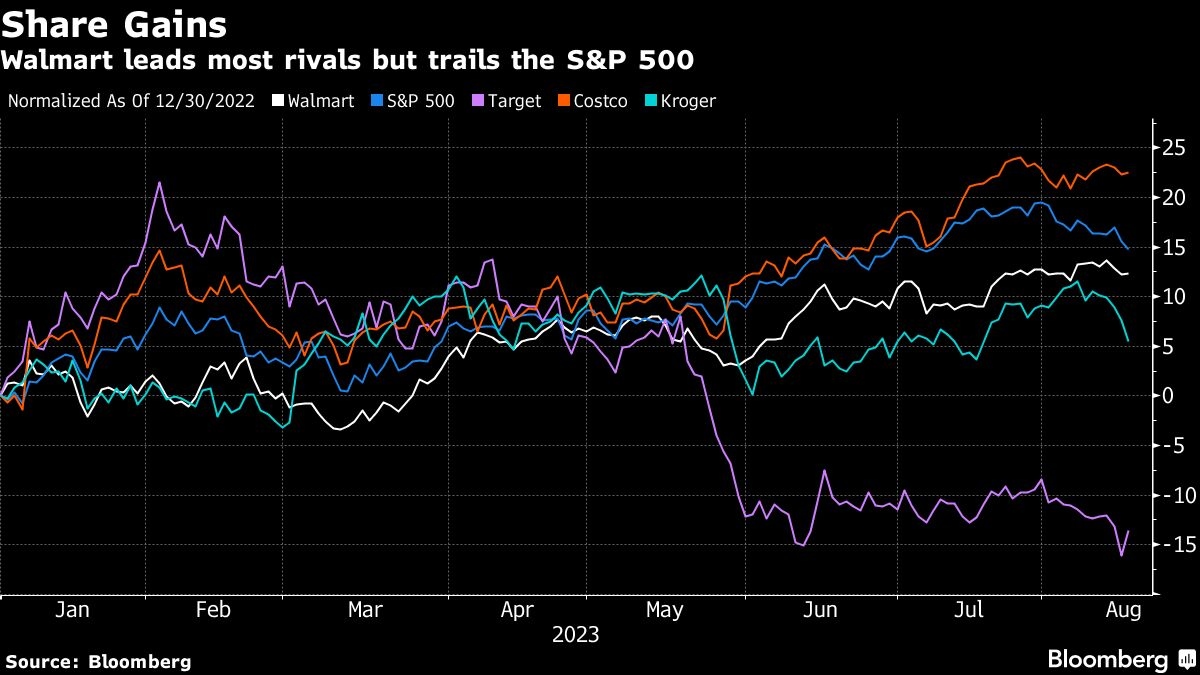

The shares rose 2.6 per cent in premarket trading. Walmart climbed 12 per cent this year through Wednesday, while the S&P 500 Index rose 15 per cent.

Adjusted earnings for the fiscal year ending in early 2024 will be as much as US$6.46 a share, Walmart said in its second-quarter results statement. The world's largest retailer had previously capped its profit outlook at US$6.20 a share. Wall Street had been estimating US$6.28.

The annual outlook includes a headwind of only five cents a share from last-in, first-out accounting, compared with a previous forecast of 14 cents.

During the fiscal second quarter, comparable sales at Walmart's U.S. unit climbed 6.4 per cent, well ahead of the four per cent average of analyst estimates compiled by Bloomberg. For the company as a whole, adjusted earnings of US$1.84 a share topped the US$1.70 projected by analysts.

Chief Executive Officer Doug McMillon and other leaders of the Bentonville, Arkansas-based company are scheduled to discuss the results on a conference call at 8 a.m. New York time.