Mar 18, 2024

WuXi Biologics’ Options See Frenzy Amid US Policy Uncertainty

, Bloomberg News

(Bloomberg) -- Traders have piled into options on WuXi Biologics Cayman Inc. to protect against potential swings, with its sister company’s earnings in focus on Tuesday.

Implied volatility for WuXi Biologics three-month options is hovering near the two-year highs reached in early February after draft legislation emerged that would block certain foreign biotech companies from accessing US federal contracts. That would largely cut off WuXi Biologics and sister company WuXi AppTec Co. from the market that generates more than half of their revenue.

WuXi Biologics and WuXi AppTec slumped as much as 6.4% and 9.9%, respectively, on Tuesday following WuXi AppTec’s Tuesday conference call and earnings report on Monday.

While revenue for the full year was largely in line with analyst estimates, the company downgraded guidance and forecast weakness in 2024 over “uncertainties in the external environment,” including potential impact from the US bill at stake.

Read more: Weight Loss Drugs Threatened by US Effort to Contain China

Analysts have warned that the proposed legislation would weaken investor confidence and re-trigger geopolitical concerns. It comes as the US and China continue to spar in a number of policy areas, citing security and technology issues.

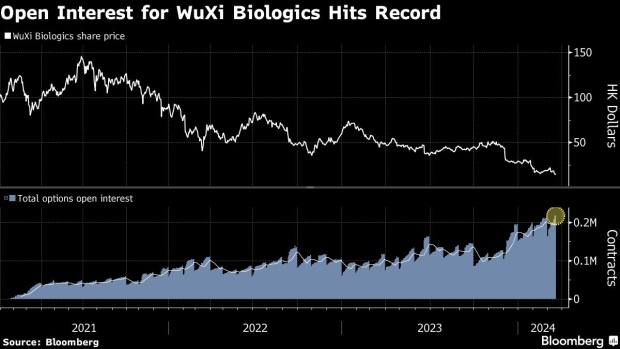

Combined options open interest for WuXi Biologics increased to a record of nearly 219,000 at Monday’s close. Open interest is nearly twice as high for calls as for puts.

WuXi Biologics shares are down 53% year-to-date, with WuXi AppTec off 50%.

--With assistance from David Marino.

(Updates with share moves, guidance downgrade starting in third paragraph.)

©2024 Bloomberg L.P.