Mar 20, 2024

Yen Is Vulnerable to Fed After BOJ Keeps Traders Guessing on More Hikes

, Bloomberg News

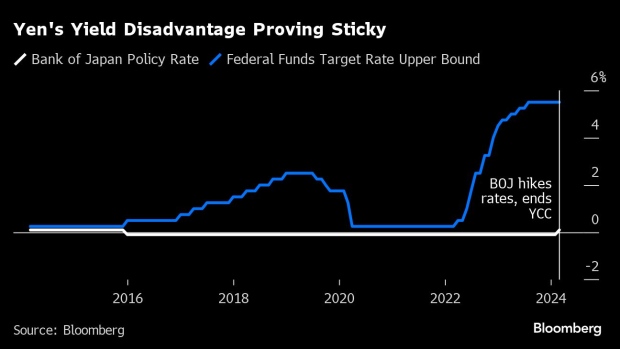

(Bloomberg) -- The yen is at risk of sliding back to three-decade lows against the dollar after the Bank of Japan ended negative interest rates without clear guidance on further hikes — leaving the Federal Reserve the key to near-term moves.

The currency continued to slide Wednesday in the wake of the BOJ’s highly anticipated shift, which had minimal impact on the yawning gap between policy rates in Japan and the US. Any narrowing of the gulf looks to be months away, with traders now focused on forecasts from the Fed later in the day for more clues.

A rapid drop from this point would likely draw jawboning from officials in Tokyo when they return from a national holiday Thursday. The cheap yen supports the nation’s equities, and keeps alive the popular carry trade for investors, but it is also a political pressure point given its tendency to fuel inflation that hurts Japanese households.

“In the very short term, the yen bears have been emboldened, and they will probably push it lower,” said Kit Juckes, chief FX strategist at Societe Generale SA. While Juckes saw the BOJ’s hike Tuesday as a pivotal moment that should herald longer-term appreciation in the currency, he noted that “right now the forces are with dollar.”

The yen slid more than 1% after the BOJ decision and traded at 151.48 to the dollar as of 4:53 p.m. in Tokyo Wednesday, putting it within range of the 2022 nadir of 151.95. It also slid to the lowest level since 2008 against the euro.

Japan’s new policy rate is 0% to 0.1%, versus 5.25% to 5.5% for the Fed and 4.5% for the European Central Bank. Analysts surveyed by Bloomberg are forecasting the BOJ’s benchmark at 0.1% at the end of this year, indicating a majority doesn’t expect another hike as a base case. But many others are still warning that the BOJ may not be finished, creating room for uncertainty.

Read more: Ueda’s Fast Move Triggers Split on Whether BOJ Is Done Hiking

“For the FX market, as long as the BOJ is not going to tighten again at the next meeting, which is very unlikely, they will take a view that ‘the coast is clear’ for a few months to continue to pursue yen-financed carry trades,” Deutsche Bank strategist Alan Ruskin said.

Others are looking beyond the next meetings from the Fed and the BOJ, instead focusing on where the long-run, or neutral, policy rates for each central bank will land.

“The more interesting question is whether the Bank of Japan is one-and-done, or do they reach a neutral rate?” said Kristina Campmany, senior portfolio manager at Invesco in New York, which is underweight Japanese government bonds in its portfolios.

According to Campmany, if both the BOJ and Fed were to reach a neutral level of interest rates — around 0.50% for the BOJ and 3.0% for the Fed, she said — the undervalued yen could ultimately strengthen 15% to 20% against the dollar.

The median for forecasts compiled by Bloomberg is for the yen to strengthen to about 139 per dollar by year end, which is a gain of around 8%.

Where that long-run monetary policy setting will land is increasingly dominating conversations on both sides of the Pacific. On Wednesday, the Fed will release a new set of forecasts, with some strategists expecting to see a revision higher in the estimated neutral rate, which currently stands at 2.5%.

Read more: Bond Traders Surrender to Higher-for-Longer Reality From the Fed

Possibly tempering the market’s reaction to the BOJ move is the large short position in yen held by global traders — nearly the most bearish in six years among hedge funds, according to data from the Commodity Futures Trading Commission.

“We need that to get rattled in a way,” said Daragh Maher, head of US FX strategy at HSBC Holdings Plc. “A rally in US treasuries would be the most immediate candidate” to shake up positioning, he said, while adding the yen could then reach 140 per dollar in the third quarter.

At American Century Investments, New York-based senior portfolio manager Lynn Chen sees potential for the yen to appreciate.

“JPY’s path forward will be determined by fundamentals like differentials in growth and rates relative to the rest of the world, and portfolio flows,” Chen said. “Rate decisions by other major central banks and carry trades can have overwhelming impact on JPY relative to BOJ this year.”

More immediately with the Fed decision looming, Mizuho Securities strategist Shoki Omori said the yen’s 2022 low may be tested if US policymakers indicate that rates will be kept unchanged for longer. He then envisages verbal warnings from officials in Tokyo but sees intervention in the market as unlikely for now.

--With assistance from Yumi Teso and Aya Wagatsuma.

(Updates prices and adds comment from strategist.)

©2024 Bloomberg L.P.