Jan 30, 2023

Yen’s Rally Comes Unstuck as Traders Eye Hawkish Fed Outcome

, Bloomberg News

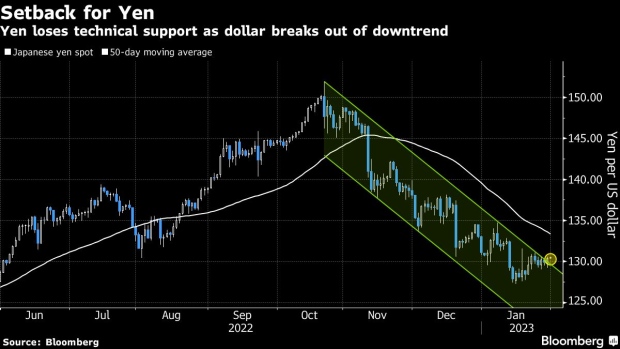

(Bloomberg) -- The rally in the yen looks to have run out of road at least in the short term, as traders shift their focus back to the policy gap between a hawkish Federal Reserve and dovish Bank of Japan.

The dollar has climbed out of the downtrend it has been in against the yen since October, when government intervention triggered a more than 16% rise in the Japanese currency. That opens the door to further gains for the greenback, with the pair’s 50-day moving average a possible target, if the Fed pushes back on bets it will soon stop raising rates at this week’s meeting.

Furthermore, the possibility that any more policy tweaks from the BOJ might not come until after Governor Haruhiko Kuroda steps down in April, has taken the momentum out of the yen’s rebound.

“Kuroda’s defiance and pattern of surprising markets and going against the consensus means we may not get any policy changes at his final meeting in March, and instead leave it to his successor to tighten policy,” wrote City Index analyst Matt Simpson in a recent note. For dollar-yen, “we still see the potential for it to extend a countertrend move.”

BOJ Veterans Remain Best Picks for Post-Kuroda as Decision Looms

©2023 Bloomberg L.P.