Nov 23, 2022

YOLO Stock-Market Options Are All the Rage This Thanksgiving

, Bloomberg News

(Bloomberg) -- Bitcoin is off the table, stock markets are gutted and bond bulls are out to pasture. In these desperate times, could folks be left with nothing more exciting to talk about this Thanksgiving than the humble equity option?

Yes, says Scott Rubner, a managing director at Goldman Sachs Group Inc. In a recent note, the expert on money flows said retail investors are wading ever deeper into the short-term derivatives trade, reprising their behavior around this time last year.

The tool of choice: Bullish contracts betting on the S&P 500 that mature in 24 hours -- speculative activity that may ultimately help fuel a broad market rally over the next month.

“I am preparing myself to get grilled by the Rubners at Thanksgiving on the worst performance of the 60/40 since 1900. I will counter with a year-end rally,” he wrote in a note to clients last week. “I expect YOLO ‘call options’ volumes to be massive” during this Thanksgiving week.

Short-expiration options gained popularity among Reddit investors during the 2021 meme stock frenzy. This year, they’ve become more than a retail phenomenon as big money managers ride the investing vehicle to navigate market turbulence.

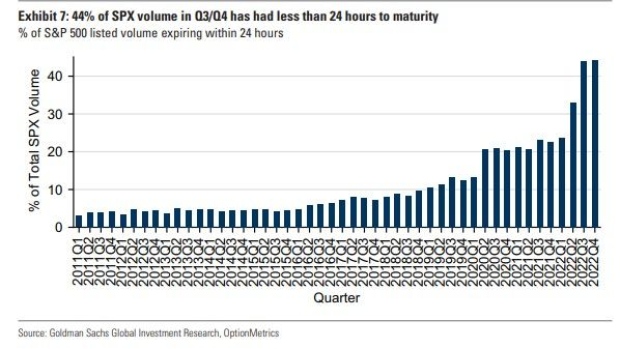

Short-term contracts made up 44% of S&P 500’s total option trading in the third quarter, about doubling from six months ago, according to data compiled by Goldman’s derivatives strategists including Rocky Fishman. On Tuesday, the proportion increased to 50%, data compiled by Bloomberg show, as the S&P 500 climbed more than 1% to a two-month high.

While consensus holds that the 11-month bear market has yet to run its course, sentiment over the short term is less bleak. Citing everything from defensive investor positioning to seasonal patterns, Morgan Stanley strategist Mike Wilson has called for a year-end rally. The S&P 500 has already jumped 10% from its bear-market low reached in October.

The way Rubner sees it, Friday’s $2.1 trillion options expiry opened the window for the S&P 500 to break out of its tight trading range in recent weeks. In this backdrop, he says, the retail army can launch “weaponized gamma” through options known as 0DTE, those with zero days to expiration.

It’s a tactic favored by some traders who bet that, as the level of a stock or an index gets closer to an option’s strike price, dealers on the other side of the transaction will have to buy more and more of the underlying security to avoid unwanted market risk.

“The lid on the topside gets removed,” Rubner wrote. “And the market is more freely to move.”

©2022 Bloomberg L.P.